Provided by the ASX Listings Team

Solid performance in secondary capital raisings offsets subdued IPO activity in 2022.

Key points

- ASX tops global ranking for volume of secondary capital raisings for third consecutive year.

- Total capital raised on ASX up 40% in 2022.[i]

- IPO activity affected by heightened volatility in equities and inflation-driven interest rate rises.

Introduction

2022 saw a marked divergence in equity capital raising activity on ASX. There was lower new listings activity as fewer companies raised equity capital through an Initial Public Offering (IPO).

But there was higher activity in secondary capital raisings as ASX-listed companies raised capital to fund organic-growth initiatives or acquisitions, as Table 1 below shows.

[i] Total new capital is based on the market capitalisation of new companies listed on ASX and total secondary capital raised on ASX. 40% growth figure compares calendar-year 2022 to calendar-year 2021. Source: ASX.

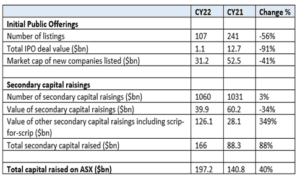

Table 1: ASX Capital Markets activity

Source: ASX. Number of secondary capital raisings refers to placements, rights issues and Share Purchase Plans (SPP). Value of secondary capital raisings refers to placements, rights issues, SPPs, dividend reinvestment plans, employee share and options issues. Total value of other secondary capital raisings includes scrip-for-scrip transactions. Total capital raised on ASX refers to the market capitalisation of new companies listed and total secondary capital raised.

Historically, the volume and value of IPOs – in Australia and overseas – falls when volatility in global sharemarkets rises. That was the case in 2022 as heightened volatility and economic uncertainty discouraged some companies from listing.

Rising interest rates was a major factor. Higher interest rates increase the cost of capital and, theoretically, lower company valuations and share prices, which was borne out in equity markets globally during 2022. Companies typically prefer to list in a rising sharemarket to attract more investors and potentially a higher valuation.

An important advantage of listing is the ability to undertake secondary capital raising such as placements, rights issues and share purchase plans (SPPs) from existing and new institutional and retail shareholders. In addition to raising funds these activities can also help stimulate liquidity. Further, listing brings the ability to acquire assets through the issue of additional equity in scrip-for-scrip transactions. Secondary capital raisings continued to be executed in 2022 despite challenging global equity-market conditions.

Secondary capital raisings

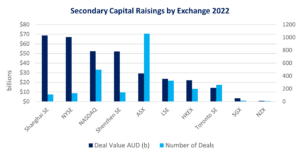

ASX was the top-ranked exchange globally for the volume of secondary capital raisings in 2022 with 1,060. This more than doubled the comparable volume on the NASDAQ exchange in the United States, more than tripled the volume on the London Stock Exchange and was higher than any exchange in Asia-Pacific.

Chart 1: Secondary capital raisings 2022

Source: Dealogic, selected exchanges. Includes main and second boards where applicable. Includes placements, rights issues and Share Purchase Plans (SPPs). Dealogic data differs from ASX secondary capital raised figure as Dealogic excludes dividend reinvestment plans, employee share and options issues.

This is the third consecutive year that ASX has led global rankings for secondary capital volumes. Globally, ASX is at the forefront of electronic trading and capital raising. ASX-listed companies benefit from efficient capital-raising processes that require minimal documentation – and Australia having the world’s fifth-largest pension pool.[i]

By value of secondary capital raisings, ASX was the fifth-ranked exchange globally in 2022. More secondary capital was raised on ASX last year than on the London Stock Exchange or Hong Kong Stock Exchange.

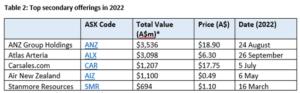

As to individual transactions, ANZ Group Holdings (ASX: ANZ) had the largest secondary capital raising with a $3.5 billion entitlement offer. ANZ raised that capital to help fund its proposed acquisition of Suncorp Bank, a division of Suncorp Group (ASX: SUN).

Toll-road operator Atlas Arteria (ASX: ALX) had the second-largest secondary offering in 2022 after raising $3.09 billion in September 2022. The proceeds were to fund the acquisition of a 66.67% majority interest in Skyway Concession Company LLC (the concessionaire of Chicago Skyway, a 12.5-kilometre toll road in the United States).

[i] Willis Towers Watson Global Pension Assets Study 2022

The top-five secondary offerings are shown in Table 2 below:

Table 2: Top secondary offerings in 2022

Source: ASX Internal Data, 31 December 2022

*Total Value includes both institutional and retail components.

“Other” secondary capital raisings on ASX in 2022 had strong year-on-year growth. This category includes scrip bids, where shares are offered partly or wholly in a takeover, in place of cash. If the takeover bid is accepted, shareholders in the target company (being acquired) receive shares in the new merged entity.

The total value of other secondary capital raisings on ASX in 2022 was $126.1 billion, from $28.1 billion a year earlier.

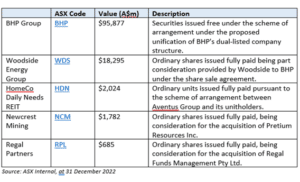

BHP Group (ASX: BHP) dominated other secondary capital raisings through the issue of securities worth $95.8 billion under the scheme of arrangement for the unification of BHP’s dual-listed company structure. The unification accounted for almost half of capital raised on ASX in 2022 and explains why total capital raised rose last year.

BHP chose ASX as its primary listing venue, in a strong endorsement of this market. As a result, BHP dropped out of the FTSE 100 index in London.

In June 2022, Woodside Group (ASX: WDS) issued $18.2 billion worth of ordinary shares to BHP Group as consideration for the sale of BHP Petroleum. BHP’s oil and gas portfolio merged with Woodside through this all-stock merger.

The largest other secondary capital raisings on ASX are shown in Table 3 below:

Table 3: Top-five other secondary capital raisings in 2022

New ASX Listings

The 2022 IPO market was the weakest in over a decade, with 107 new listings raising $1.1 billion in IPO capital. In 2021, 241 listings raised $12.7 billion, in an exceptionally strong year that skews year-on-year comparison. The average number of new listings over the past five years was around 140.

Sharply lower IPO activity was evident on exchanges globally. Capital raised in the US IPO market in 2022 fell 92% in 2022, year-on-year.[i]

Several factors explain lower IPO activity on ASX. Heightened volatility in global equities weighed on listings activity, driven by the Ukrainian War, supply-chain issues and the inflationary environment. More companies shelved their IPO plans as global equity markets fell.

On the back of rising inflation, higher interest rates worldwide was another IPO headwind. Expectations that central banks would lift rates to tame rising inflation particularly affected valuations of technology and other growth stocks. These conditions made it harder for some IPO candidates to achieve the valuations they hoped for, prompting them to defer or shelve their listing plans.

At the same time, small-cap companies on ASX (as measured by the S&P/ASX Small Ordinaries Index) underperformed large-cap companies (S&P/ASX 200 Index) in 2022.[ii] That made IPO conditions for small-cap companies, which comprise the bulk of the IPO market by listings volume, more challenging.

By sector, Materials accounted for 58% of new listings on ASX in 2022, followed by Energy at 9%. A highlight was mining companies raising capital to explore for lithium and other “green metals” used in renewables infrastructure and technologies.

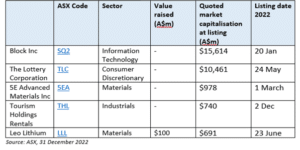

US payments giant Block Inc (ASX: SQ2) was the largest new listing on ASX by market capitalisation, after it acquired Afterpay, an ASX-listed company that provides Buy-Now, Pay-Later services. Block Inc quoted $15.6 billion in market capitalisation on ASX when it dual listed[iii] in January 2022. Block was a prominent addition to the S&P/ASX All Technology Index.

The Lottery Corporation (ASX: TLC) was the second-largest listing in 2022 by market capitalisation at listing ($10.4 billion). The company was created following the Tabcorp Holdings (ASX: TAH) demerger in 2022.

[i] Source: Dealogic, 31 December 2022

[ii] Source S&P. Based on one-year comparision of S&P/ASX Small Ordinaries Index and S&P/ASX 200 Index on a total return basis over one year to 16 January 2023.

[iii] Block Inc is dual listed on the New York Stock Exchange and ASX.

The largest listings by market capitalisation are shown in Table 4 below:

Table 4: Top-five new listings on ASX in 2022

2023 capital raising outlook

In January 2023, 10 companies had applied for admission to ASX through an IPO. Most were from the Materials or Energy sector and several IPOs sought capital for green-metal or clean-energy projects – a continuing IPO theme from 2022.

VHM (ASX: VHM) and Gold Hydrogen (ASX: GHY) listed early in 2023 as well as tech company Acusensus (ASX: ACE).

Although upcoming listing applications suggest continued subdued activity in the first half of 2023, there is reason for cautious optimism that IPO volumes and values will improve this year. At the time of writing, the S&P/ASX200 Index was up over 7% to date in 2023, recouping its 6.3% loss in 2022.

As Chart 2 below shows, volatility in Australian equities – as measured by the S&P/ASX200 VIX Index (A-VIX) – has fallen since October.

As of January 2023, the A-VIX had consolidated back into the 10-15 range – a range where IPOs on ASX have historically been more active. Market conditions might become more favourable for IPOs if the February company-reporting season meets or beats investor and analyst expectations and this period of lower volatility in the Australian equity market continues into the second quarter of 2023.

Chart 2: S&P/ASX 200 VIX Index

Source: Market Index

An expected easing of interest-rate rises in 2023 (based on economist forecasts), followed by a period of interest-rate consolidation, could also aid IPO activity. If investors believe interest rates have peaked and inflation is under control, more confidence could return to the global IPO market.

The listings pipeline has continued to build over the past 12 months and several companies have prepared to take the opportunity to come to market once the IPO window reopens more broadly.

Also, given activity in private markets, an increasing number of unlisted companies are likely to consider an IPO to access capital and gain liquidity for early investors.

IPO activity can change quickly when market conditions turn. Media outlets[i] have speculated that several large companies from the aviation, pharmaceutical, retail, telecommunications and entertainment sectors could list in 2023 or 2024.

Potentially lower volatility in equities and greater economic certainty this year could also aid activity in secondary capital raisings in 2023. Companies are more likely to raise capital to pursue organic growth initiatives or acquisitions if greater confidence returns.

[i] Australian Financial Review. 5 January 2023. https://www.afr.com/markets/equity-markets/dealmakers-put-hopes-on-late-ipo-rush-20221212-p5c5pg