By Doug Morris, CEO, Sharesight

Digital technology is transforming how Australians manage their money. From banking apps to budgeting platforms, and increasingly, self-directed investing tools, digital solutions are now deeply embedded in day-to-day financial life. According to recent research, one in three Australian investors use digital tools to manage or trade their investments, and this number continues to grow.

Robo-advisers are a prime example of this shift. These online platforms offer low-cost, automated financial advice through intuitive interfaces, making them particularly appealing to investors who value simplicity and affordability. With the robo-advice market expected to grow at nearly 7% annually between 2024 and 2028, it’s clear that demand for digital investment solutions is here to stay.

But while self-managed investing is on the rise, it doesn’t eliminate the need for human financial advice. In fact, the growing complexity of investment decisions has created new opportunities for advisers to offer targeted support to digitally engaged investors. Many investors use online platforms to execute trades or view their portfolios, but still seek expert guidance when it comes to tax strategies, long-term planning, and making sense of market fluctuations. This gives an advantage to investment advisers using a digital-first business model.

The opportunity in digital-first advice models

Today’s most effective investment advisers are those who embrace digital-first advice models, which blend automation with personalised service. These models acknowledge that while digital platforms offer speed and convenience, they simply cannot replicate the nuance, judgement and empathy that a skilled adviser brings to the table.

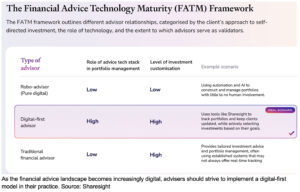

In our latest research, we introduced the Financial Advice Technology Maturity (FATM) Framework, pictured below. The Framework sets the scene for the current investment advice landscape, providing key insights into the level of technology used by each type of adviser and the level of investment customisation clients can expect. As noted in the Framework, digital-first advisers use a high level of technology for portfolio management, while also offering a high level of investment customisation — an ideal scenario for both adviser and client.

By using a tool like Sharesight’s portfolio tracker, for example, advisers not only save time on portfolio management, but they also unlock performance insights that are typically beyond the reach of self-managed investors. By giving clients access to an easy-to-read overview of their investment portfolio(s), advisers can shift conversations away from unnecessary status updates and towards higher-value discussions around strategy, performance and how investments align with the client’s goals.

Turning portfolio data into conversations

As we touched on previously, at the heart of digital-first advice is the ability to turn data into meaningful dialogue. Sharesight’s diversity report, for example, provides a visual breakdown of a client’s asset allocation across different classes, sectors, markets and more. Advisers can use this to assess whether a client’s portfolio aligns with their financial objectives or is overly concentrated in one area — an issue that self-directed investors often overlook.

Grounded in performance attribution principles, the contribution analysis report takes this further by identifying which asset classes are driving overall portfolio performance. This allows investment advisers to demonstrate the impact of past recommendations or to re-evaluate strategy based on real results. It’s particularly helpful in justifying portfolio rebalancing or in illustrating how tactical changes can affect long-term returns.

Encouraging deeper risk discussions

Risk management is another area where human insight matters most. With Sharesight’s risk report, advisers can clearly show the relationship between risk and return in a client’s portfolio.

The report provides a visual representation of the risk-adjusted return of each holding based on its RoMAD (Return over Maximum Drawdown) score. This offers a foundation for conversations about risk tolerance and potential adjustments.

These insights are particularly impactful in times of market volatility, when emotions can lead to poor decision-making by investors. By referencing the risk report, advisers can ground their guidance in concrete data that helps clients understand the true implications of their investment choices.

Supporting long-term planning with income insights

Sharesight’s future income report gives advisers a forward-looking view of announced dividends — something investors often fail to consider when evaluating their income strategy. This tool is especially valuable for clients approaching or in retirement, helping them plan for cash flow, compare income from different assets, and ensure that their portfolio continues to meet their lifestyle needs.

It also opens the door to broader discussions about wealth preservation, estate planning and tax efficiency, which are all areas where advisers can provide critical, tailored support that robo-advisers can’t match.

Automation that works with you, not instead of you

One of the key benefits of platforms like Sharesight is their ability to automate routine tasks such as performance tracking, tax reporting and dividend tracking, freeing up advisers to focus on strategy and client relationships. Instead of spending time wrestling with spreadsheets or manually reconciling data, advisers can rely on Sharesight to ensure portfolio data is accurate, real-time and ready to share.

This efficiency not only boosts practice profitability but also enhances the client experience by delivering faster, more consistent service.

Staying relevant in a digital world

As the landscape continues to shift, it’s clear that clients no longer need to choose between digital tools and human advisers — they expect both. By integrating platforms like Sharesight into their advisory process, investment advisers can offer a modern, tech-enabled service that meets client expectations without sacrificing tailored advice and human connection.

The future of wealth management isn’t about competing with digital solutions — it’s about using them to amplify your value. In doing so, advisers can remain indispensable to clients who are more financially empowered, tech-savvy and outcome-focused than ever before.

Download our new white paper, 5 key challenges shaping financial advice, to learn more about what leading advice firms are doing to future-proof their practices, and how you could benefit from embracing a digital-first advice model.