By Mark Power, Head of Income Credit, Qualitas

CRE credit (or CRE debt) refers to secured loans to commercial borrowers that finance real estate for investment and development purposes. When these loans are not provided by a bank, this is referred to as ‘private credit’.

CRE private credit offers unique portfolio diversification benefits given its performance is generally not correlated to traditional bond market performance or the property market cycle, despite having some cross-over. For this reason, it is often classified as an alternative asset exposure. Additionally, depending on the risk profile of the investor, different types of CRE exposure can be included in a portfolio.

Benefits of CRE credit include income certainty via loan payments and capital preservation characteristics. Investor (lender) protections are delivered through the existence of mortgage security and the borrower’s equity buffer. For example, a typical loan to value (LVR) ratio of 60% provides significant protection to the lender in the event that property prices correct during a property cycle. CRE private credit provides exposure to the growing CRE market without the risks of property ownership where losses are first absorbed. The asset class has the potential to provide attractive risk-adjusted returns and, depending on the product, provide a regular and predictable income stream through the borrower’s monthly interest repayments.

What is propelling this investment opportunity?

With Australia’s residential vacancy rate at a record low at 0.7%1 and net overseas migration at a record high at 548,800 people2, it has never been more apparent that Australia requires significant new housing supply to meet demand. This creates opportunities for CRE private credit lenders to assist with flexible financing solutions for borrowers to meet the estimated demand of 300,000 new apartments needed over the next four years3.

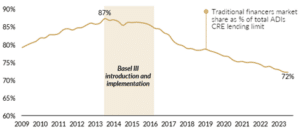

Further propelling this opportunity is the reduced participation in the market by banks (as seen in the chart below) due to onerous capital provisioning requirements enforced following the global financial crisis (GFC). By filling the gap left by banks, CRE private credit lenders have cemented their role in the market, and it is expected that they will continue to gain market share as macroeconomic tailwinds persist.

Traditional financiers reduced share of CRE lending since GFC4,5

Access to CRE lending made simple

Investing in what was once an asset class only accessible by institutional investors, has become much easier via listed or unlisted investment vehicles. The Qualitas Real Estate Income Fund (ASX:QRI) specifically provides investors access via ASX to a pure-play CRE private credit fund with a Mortgage Real Estate Investment Trust (MREIT) structure. MREITs service, originate, purchase and securitise commercial and mortgage loans. They simplify access for non-institutional investors to this previously illiquid asset class, with the expertise of a specialist investment manager backed by multi-cycle experience. MREITs also provide liquidity in what would otherwise be a close-ended structure, meaning the manager isn’t forced to sell assets (loans) to fund investor redemptions. The manager can focus purely on investment selection and portfolio management.

QRI not only provides portfolio diversification, but also aims to achieve a target rate of return between 5% to 6.5% above the RBA cash rate (net of fees and expenses) to deliver monthly cash income for investors6.

Key risks

Two primary risks of CRE credit include the loss of loan principal, which is when a borrower cannot repay the loan and the security property value declines and is insufficient to meet the full loan repayment. Second, the loss of loan income, when the cash flow from the property or other borrower sources are insufficient to pay loan interest and fees due to the lender.

This specialist asset class requires intensive asset management and risk management, fund manager selection is therefore critical when investors do their product due diligence.

Notes

- Domain, Vacancy Rates: February 2024.

- ABS, Overseas Migration, during the year ending 30 September 2023.

- CBRE

- APRA Quarterly ADI Commercial Property Exposures September 2023.

- APRA Monthly Authorised Deposit-taking Institution Statistics September 2023.

- The payment of monthly cash income is a goal of the Trust only and neither the Manager or the Responsible Entity provide any representation or warranty (whether express or implied) in relation to the payment of any monthly cash income. Returns are not guaranteed. The premium achieved is commensurate to the investment risk undertaken.

Disclaimer:

This communication has been issued by The Trust Company (RE Services) Limited (ACN 003 278 831) (AFSL 235150) as responsible entity of The Qualitas Real Estate Income Fund (ARSN 627 917 971) (“Trust” or “Fund”) and has been prepared by QRI Manager Pty Ltd (ACN 625 857 070) (AFS Representative 1266996 as authorised representative of Qualitas Securities Pty Ltd (ACN 136 451 128) (AFSL 34224)). This communication is general information only and is not intended to provide you with financial advice and has been prepared without taking into account your objectives, financial situation or needs. The Trust Company (RE Services) Limited (ACN 003 278 831) (AFSL 235150) is the Responsible Entity and issuer of units in the Qualitas Real Estate Income Fund (ARSN 627 917 971) (“Trust” or “Fund”). QRI Manager Pty Ltd (ACN 625 857 070) (AFS Representative 1266996 as authorised representative of Qualitas Securities Pty Ltd (ACN 136 451 128) (AFSL 342242) is the investment manager of the Fund. Prior to making a decision about whether to acquire, hold or dispose of units in the Fund you should consider the Product Disclosure Statement (PDS) and target market determination (TMD) for the Fund to see if it is right for you. The Fund’s PDS and TMD is available at www.qualitas.com.au/qri. Past performance is not a reliable indicator of future performance.

This article is general information and does not consider the circumstances of any investor or constitute advice. Material published in SIAA Newsroom is copyright and may not be reproduced without permission. Any requests for reproduction will be referred to the contributor for permission.