By Grant Bloxham, Chief Executive Officer, BStar

When we discuss with investment advisers the benchmarking of their business, they are usually focussed on improvement planning. However, the benefits of using benchmarking data extend far beyond growth and improvement.

Benchmarking data and information can be used for multiple purposes including but not limited to:

• Valuing a business;

• Succession or exit planning;

• Analysing non-financial risk and value drivers;

• Asset protection; and

• Comparing owner(s)/staff salaries and benefits to market.

In this article, we share insights on three powerful and compelling ways to use benchmarking data.

1. Improvement benchmarks

Improvement benchmarking enables you to calculate and then compare your business’s key performance indicators (KPIs) to both the relevant industry average and benchmark performance (i.e. the average of the top 20%).

An immediate benefit is to rank where your business sits within its industry, and identify where there are opportunities to improve performance.

For example, Bstar’s stockbroking profit benchmarks indicate a business performing with an average profit margin has a 53.6% improvement opportunity, when compared to the top 20%.

The benchmarks displayed are sourced from Bstar’s multi-disciplinary stockbroking benchmarks database.

Using benchmarking data to identify improvement opportunities also benefits your business succession plans.

Future successors can be risk adverse. One of the major challenges facing owner(s) wanting to sell part of their business to staff identified as potential successors, is securing their interest and financial commitment to purchase equity in the business.

By using benchmarks to identify measurable improvement opportunities, owners can demonstrate how successors will grow the value of their interest in the business. This supports a smooth transition in the change of ownership.

2. Valuation benchmarks

One of the biggest issues facing the professional and financial services sectors is succession planning.

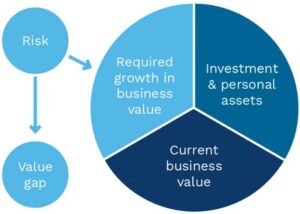

88% of SMEs have a value gap risk. *

Typically, the first step is to value the business as it is today. A current valuation can be used to identify an owner’s surplus or shortfall in value & align the owner’s and successor’s expectations before documenting the transaction.

Having access to industry valuation benchmarks allows all parties to have a better understanding of what constitutes “fair market” values.

Another issue when completing a business valuation is demonstrating independence.

Being able to compare the valuation assumptions (profitability & multiples) and outcomes (value of enterprise or entity NTA) to similar businesses is essential to gain the trust of the affected parties, whether they are successors, investors, financiers, or owners exiting the business.

Benchmarking data strengthens the integrity of the valuation process by providing external validation of the valuation. It is also a key requirement of the Australian Taxation Office that business valuations for restructuring, asset protection & insolvency purposes be evidence based.

*Bstar 2021/2020 SME Research Report. The ‘value gap risk’ is the risk that the business value is not sufficient to support the owner’s next life stage plans, or to fund retirement.

3. Owner/Staff salaries and benefits benchmarks

Industry Owner/Staff salaries and benefits benchmarks provide up to date information on market remuneration benefits for owners and experienced staff. These are key inputs when analysing a business’s performance and value.

| Less than 5% of SME owners are paying themselves a commercial salary. * |

One of the key adjustments made when determining the true profitability and value of a business is recording the variance between the actual salaries or benefits being paid to the business’s owners and the relevant commercial or ‘notional’ salary that would be payable to hire someone for those position(s).

Extract of Bstar’s upcoming Industry Owner(s) Benefits Benchmark Report.

If an owner is paying themselves a salary that is less than market or commercial rates, the salary adjustment used when valuing the business will usually reduce the deemed profitability and value.

When an owner understands this issue, and its impact, it can be addressed well before formalising the business’s succession plans or the owners exit.

These benchmarks can also assist with attracting and retaining experienced staff.

By using up to date information on market salaries and benefits, owners can tailor attractive remuneration packages to recruit the talent needed to grow their business.

Furthermore, benchmarks demonstrating the potential improvement in earnings when becoming an owner, is a popular management succession strategy to retain key staff.

*Data from Bstar’s Owner(s) Benefits Benchmarks database.

First step

Access information via the SIAA website. Bstar is collaborating with the SIAA to make this information available to investment advisor members.