ASX-listed investment products are growing in range and popularity, with investors using them to diversify their portfolios cost-effectively. ASX Senior Manager of Investment Products, Rory Cunningham, explores key trends.

There are more than 600 investment products listed on the ASX. These pooled investment vehicles include exchange-traded products (ETPs) such as exchange-traded funds (ETFs), listed investment companies and trusts (LICs/LITs), real estate investment trusts (REITs), infrastructure funds and mFunds, which enable investors to buy and sell unlisted managed funds via a participating broker on the ASX.

In the last number of years the popularity of ASX-listed investment products has surged. So who’s investing in them – and why?

A compelling growth story

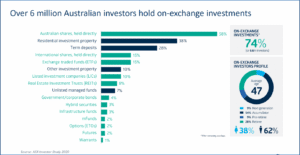

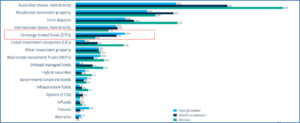

To find out, let’s look at data from our biennial ASX Investor Study, which provides valuable insights into investor behaviour. Our 2020 study revealed that of the 9 million Australians who are investors, 74% hold investments on-exchange. While most of these people hold direct shares, an increasing number are moving their investments to ASX-listed investment products.

Source: ASX Investor Study 2020

To give you an idea of the overall pace of investment uptake, we can take a look at the ETP and ETF market to understand the rate of growth being experienced. The first ETF was listed in Australia 20 years ago. We now have 248 ETFs valued at $130 billion in market capitalisation.

Source: ASX Investment Products Report – April 2022

As well as retirees and wealth accumulators, we’re seeing a marked trend in next-generation investors adopting ETFs. Unlike older investors, younger investors are bypassing shares as their first-time investment in favour of ETFs. These younger investors are likely to have fewer funds to invest than those more advanced in their wealth journey, so the cost-effectiveness and broad access offered by ETFs helps explain why they’re so attractive.

Source: ASX Investor Study 2020

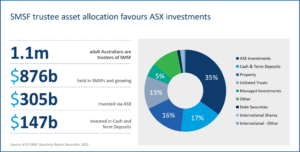

Of the 1.1 million adult Australian SMSF trustees, 35% of their $876 billion in assets are held on the ASX. While SMSFs have historically focused on investing in shares, products like ETPs, LICs/LITs and mFund are gaining interest among these investors. In fact over 70% of inflows into mFunds are coming from SMSFs. We’re following SMSF trustees with interest to see where they invest their money in the coming years – especially as many approach retirement – to see whether they continue to invest beyond Australian shares to achieve diversification into areas such as fixed income and global equities

Source: ATO SMSF Quarterly Report December 2021

Broadening horizons in a convenient, transparent and cost-effective way

Like shares, ASX-listed investment products can be held on an investor’s holder identification number (HIN). This provides increased transparency and certainty with the settlement process, making them efficient to buy and sell.

They are also a cost-effective way to diversify, making it possible for investors to benefit from a range of asset classes and investment strategies. For example, investors are using mFunds to gain exposure to active fixed-income strategies that haven’t previously been available via the exchange. And, while ASX-listed investment companies and trusts have been around since 1923 and historically offered exposure to Australian shares, in the last five years we’ve seen them expand into areas such a private debt, private equity and other alternative investment strategies.

We’re increasingly observing investors taking a core and satellite approach to portfolio construction using the options that are available on ASX. This typically means they are using index-tracking ETPs to gain exposure to key markets to achieve diversification and reduce costs, and they then invest their remaining capital into actively managed funds or thematic ETFs aiming to earn above-benchmark returns.

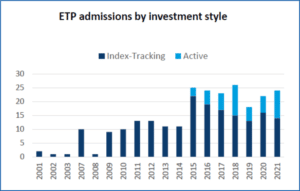

Traditionally, ASX-listed investment products have been seen as a low-cost solution for investors, largely because most take a passive, index-tracking, investment approach. However, since 2015, ETPs that employ active strategies have come to market, expanding the range of strategies available to investors.

Source: ASX

Considerations when using ASX-listed investment products

Investment products may not be right for all investment goals or personal situations. Like all pooled structures that are managed by professional investment managers, fees and charges apply, and the fund manager is responsible for all asset sale and purchase decisions, so the investor has no control over the decisions made at the fund level. There are also differences in the types of investment product structures available on ASX. We have prepared an Understanding ASX Investment Products Booklet to help advisers understand the differences between the structures available on ASX. The booklet can be accessed by clicking on the link above, or by visiting the financial adviser page of the ASX website.

Better for your client, better for you

In our view, ASX-listed investment products can provide advantages for brokers and clients alike. For example, investing directly in managed funds requires reams of paper forms. But by choosing mFunds – unlisted managed funds that are accessed on the exchange – you can avoid application forms. Identification checks are performed by the broker once, rather than by each fund manager. Applications for units are facilitated via CHESS and units are held on the investor’s HIN. This saves you time and provides your client with a more seamless and convenient service.

What’s more, mFunds offer your clients sophisticated and wide-ranging active investment options. This makes them particularly appealing to clients with SMSFs who’ve traditionally had fewer diversification opportunities compared to institutional superannuation funds.

Learn more

If you would like to know more about ASX-listed investment products, contact the ASX team at [email protected] or myself at [email protected].

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information. © Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2022.