By Bill Keogh, CEO Transact1, a FinClear Group company

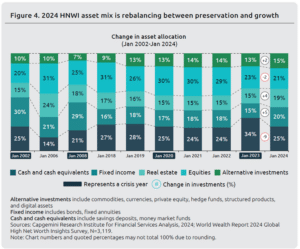

As rates remain high, investors should expect strong returns on cash holdings, which provides low risk, strong risk-adjusted returns, and liquidity – an attractive prospect in current market conditions. With cash allocations reverting to historical norms within your client’s portfolio, seeking the best rates in the marketplace is paramount as the improved contribution to overall return can be meaningful.

The dark art of Cash Management

Term deposits remain the easy go-to cash product but are time consuming for brokers and advisers to set up and manage. Given our familiarity with cash, it’s an easy mistake to be overconfident with what many view as the most-straightforward asset class as simple, easy or passive.

For example, many products appearing to be “cash” actually preclude its benefits, with higher risk profiles, fees and penalties that chew through margins and have 30-day break terms reducing your interest payments.

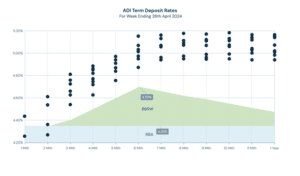

As seen by the chart below, it’s not a case of just calling your bank. Term deposit rates are not easily accessible, and highly elastic to demand, yet to maximise returns you need to find those lucrative rates and follow them from bank to bank. Banks are price-makers depending on their requirements, not yours and these requirements are always changing.

Transact1’s proprietary research clearly indicates an obvious and persistent dispersion of rates across banks and across all term periods. However, this dispersion uniquely presents itself when one negotiates directly with the liquidity provider and abstracted away from any potential intermediary, such as a wrap platform or master trust.

When considering all of the above factors, it is clear that a using a cash asset specialist is imperative so that as an adviser one doesn’t have to keep up to date with the best rates and offers and also avoid a high admin burden and a drain on your time.

Cashing in on cash

The most effective solution is to outsource, leveraging a specialist provider for their efficient access into this opaque market and up-to-date market information. FinClear offers an established alternative to direct term deposits: an actively managed portfolio of term deposits (managed by FinClear company Transact1) that eliminates the hassle of sourcing rates and the ongoing commitment of resources used up by managing term deposit investments.

The FinClear Wealth Cash Income Fund uses proprietary technology to automate the search for best rates on an intraday basis. Transact1’s strong relationships and singular focus on cash mean it has the market knowledge, expertise and clout to achieve better outcomes for your clients’ cash.

Transact1 leverages economies of scale and efficiencies to access competitive rates, move funds to the most competitive offerings and navigate the fees, terms and other intricacies of dealing with the big banks, making the banks work for you and not the other way around.

The Fund offers compelling returns, transparency and liquidity, by blending term deposit rates from a broad range of ADIs not available on your direct term deposit panel, such as Westpac, CBA and Bank of Tokyo to consistently outperform traditional cash returns.

Importantly for time-poor advisers and brokers, it does all the paperwork for you, taking care of AML/KYC, reporting and managing cash flow movements, reinvestment, maturities, as well as finding the best rates on offer to include in the portfolio. Unlike direct term deposits, your funds will not be locked up for a specified time, providing monthly income and keeping your clients in your ecosystem.

Built for advisers by advisers, the FinClear Wealth Cash Income Fund has low fees and a proven track record of performance over more than six years, this is brokers’ and advisers’ secret weapon to make cash work hard while you don’t.

For more information, please contact [email protected].

This article is general information and does not consider the circumstances of any investor or constitute advice. Material published in SIAA Newsroom is copyright and may not be reproduced without permission. Any requests for reproduction will be referred to the contributor for permission.