By Stuart Frith, Head of Data, FinClear

You know what your clients did last year, but how did they compare to other retail investors? When it comes to investment strategies, what won last financial year and how did different investors behave? We used AI to deep dive into the behaviours of high-net-worth (HNW) investors and this is what we found.

Top performers are more diversified, less active

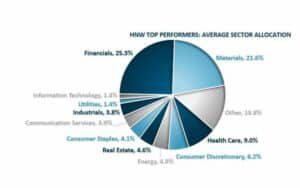

The 10% of HNW investors with the highest returns in FY23 achieved an average return of 24.2% – impressively outperforming the index by almost 10%. When adjusted for risk taken, their returns were 1.5x the benchmark. These top performers had six key things in common:

1. Balanced portfolio: they held average of 15 holdings across six sectors, compared to the average 5 holdings in two sectors of the weakest performers.

2. Mature companies: they saw average dividend earnings of $70k (versus $12k for weak performers), suggesting holdings in more mature companies rather than early-stage.

3. Not overactive: they had a portfolio turnover of 0.2 – they actively managed investments, but were far less active than weaker performers.

4. High allocation to Financials: they held a quarter of their portfolio in Financials on average, compared to just 8.2% of portfolios that saw the weakest returns.

5.Balanced allocation to Materials: they held 21.6% of their portfolio in Materials on average – almost half that of weakest performers.

6. More in ETFs: 13% of portfolio on average was allocated to ETFs – four times as much as weak performers.

HNW women have bigger portfolios, higher returns

Advisers know that more women are investing than ever before – half of investors joining the market since 2020 are female.

Male investors still represent a majority in Australia and have 62% larger portfolios on average. Amongst HNW investors, women are underrepresented by the same amount as in the wider population (comprising 42% of investors in our dataset), but surprisingly have larger portfolios. The average portfolio size for HNW female investors was 8% larger than their male counterparts – and skewed to higher values (the top 10% of female HNW accounts are $2.8mn on average vs men’s $1.6mn).

It has been repeatedly reported that women are better investors, more likely to achieve higher overall returns, due to “overconfidence” and “overactivity” in men. In FY23, HNW female and male investors with diversified portfolio strategy achieved similar returns, via different approaches.

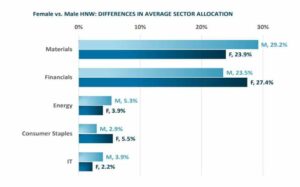

Male HNW investors on average allocated more of their portfolios to more volatile growth sectors. They were also more active, with 50% of men turning over 0.65 times their total portfolio in the year, whereas for females the equivalent metric is 0.45. Female investors allocated more of their portfolio to more stable sectors and diversified into more sectors, and hence could be less active in the market. Notable differences between male and female HNW portfolios included:

- Female investors had a 20% greater allocation to the Finance sector than men, whilst men have a 20% greater allocation to the materials sector (mining companies) than their female peers.

- Men have almost double the allocation to tech stocks than women (e.g BLOCK, WiseTech, Xero, SEEK etc), although not significant amounts overall. Women hold almost double the allocation to consumer staples, 5.5% of portfolio on average, vs 2.9% for men (Woollies, Coles, Endeavour wines, A2 Milk, Costa Group etc).

- Women are slightly more likely to hold ETFs than men (11% vs 9.3%).

While the results of these differing approaches can – and in 2023 did – yield similar results, their success is dependent on the market circumstances in which they are operating. In CY22, FHNW investors performed better than their male counterparts (more in keeping with usual gender-based investment research). This was due in part to macro events that produced more volatile market conditions, such as the war in Ukraine and tech stock correction, which favoured a more conservative selection of sectors and stocks.

In FY23, female HNW investors adopting high conviction strategies outperformed male investors by 7.5% – which for an average HNW portfolio equated to an upside of $75,000. The primary difference being a 44.4% higher rate of trading by males. This gap adheres to previous research that finds men trade more (45% more in some research – 67% more for single men vs single women), and that such active trading behaviour, hypothesised to be due to overconfidence, can hurt performance.

Top four reporting season flows

After months of growing inflation, cost of living, and higher interest rates, Australian businesses faced a more volatile reporting season. With hindsight, August saw slightly better-than-expected revenues reported – here are some of the most popular and lucrative trades that took place:

MQG: From the day the bank reported, Macquarie’s share price dropped and many investors bought Macquarie shares in the week following, suggesting long-term shareholders bought as the price fell.

JHX: Many investors sold their James Hardie shares in the month leading to the announcement, but the week after saw an even sharper spike in selling as the share price jumped up with investors capturing profit after six months of the price rising.

SQ2: Investors sold Block shares ahead of its announcement, near the top of the market, and bought in the week after when the share price fell steeply. Many investors sold at a 6-month peak and bought back in as it dropped near 6-month lows.

RMD: Investors began to buy Resmed shares in the month leading up to its announcement, increasingly so as prices dropped.

HNW investors – with their advisers – were good at picking the near-zeniths and floors in these share prices, anticipating announcements that saw a drop in prices when they sold before and bought back after. Or, they sold as prices climbed off the back of an announcement, after buying at lower prices earlier in the year.

Download a copy of the full report here

[1] “Why Women Are Better (Investors) Than Men”, Forbes 2023