Provided by Michelle Huckel, Policy Manager, SIAA

The Compensation Scheme of Last Resort (CSLR) has released the estimates for the industry funded levy, with licensees that provide advice to retail clients paying the lion’s share: a minimum levy of $100 plus $1,186 per adviser for the second levy period.

The CSLR was enacted in 2023 to compensate complainants who have received a determination in their favour from AFCA and the determination amount has not been fully paid by the relevant financial firm. This typically occurs because the relevant financial firm is insolvent,or is likely to become insolvent.

The Scheme will commence operations from 2 April 2024. CSLR Limited, a not-for-profit company limited by guarantee that is a subsidiary of AFCA, is authorised as the operator of the Scheme. The set-up work conducted prior to the commencement date has been funded by a budget appropriation. The Scheme is funded through levies.

The Scheme provides for the following payments:

• Compensation payments for claims lodged for unpaid AFCA determinations. Claims are limited to $150,000 per complainant.

• Unpaid AFCA fees.

• CSLR operating costs.

• ASIC costs for administering the Scheme levies.

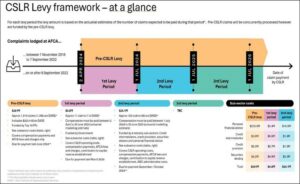

The Scheme has issued a levy framework summarising the various levies and levy periods:

• The Pre-CSLR levy of $241 million will be funded by the top 10 largest APRA-regulated financial institutions (other than private health insurers and superannuation funds) and covers approximately 1,914 claims. 1,556 of these claims are against Dixon Advisory Superannuation Services (DASS) lodged with AFCA between 1 November 2018 and 7 September 2022 (these are referred to as Pre-CSLR complaints).

• For complaints lodged on or after 8 September 2022 (Post-CSLR complaints), levies are determined annually (noting that the first levy period runs only from 2 April 2024 to 30 June 2024). The levy for the first levy period of $4.8 million is funded by government and covers approximately 11 claims (of which 1 is a complaint against DASS).

• The levy for the second levy period of $24.1 million will be funded by industry and covers approximately 129 claims (of which 86 are against DASS). The second levy period is from 1 July 2024 to 30 June 2025. This is the levy that will be funded by credit intermediaries, credit providers, securities dealers and personal financial advice providers and is due for payment in September/ October 2024.

The levies for the first and second period will meet the cost of expected CSLR claims payments made to claimants during the levy period.

The total levy for each levy period is capped at $250 million, and, in addition, each sub-sector has a $20 million cap unless there is a ministerial determination for a Special Levy to exceed this amount. In all cases the $250m cap for the levy period will apply.

Annual levies starting from the second levy period will be calculated and imposed on industry by ASIC. It will use the estimate determined by the CSLR operator for the levy period in calculating the levy.

To assist firms calculate their leviable share, ASIC has provided a levy summary for the second levy period. The industry data collected from the Industry Funding annual return will be used for the calculation of levies.

[1] Amounts are rounded to the nearest $1000.

[2] Levy amounts have been rounded.

The estimate of the levy for the first and second levy period is uncertain. This is because the CSLR is a new arrangement and has not commenced operating. The key uncertainties affecting the levy for the first and second levy period amounts relate to the financial advice subsector, and specifically the total cost of DASS related complaints and the timing of their determination by AFCA. DASS complaints represent more than 80% of the currently open, in-scope, post-CSLR complaints and around 70% of the total estimated claim payments. This includes complaints lodged with AFCA after 8 September 2022 and future complaints lodged up to April 2024, after which DASS’s AFCA membership is expected to expire and complaints can no longer be lodged with AFCA against the firm. The actuarial report in support of the estimated levy amounts for the first and second levy periods concluded that most, if not all, of the post-CSLR complainants in relation to DASS will be free to have their complaint determined and, if a successful determination is made, to then lodge a claim with the CSLR. The decision of the Federal Court in ASIC’s action against DASS strongly supports the assumption that these complainants will be largely successful.

The new CSLR website contains detailed information on the CSLR’s role, consumer claims process, levy framework and estimates as well as the actuarial report for the 1st and 2nd levy period estimates.