By Elfreda Jonker – Investment Specialist, Alphinity Investment Management

Contrary to expectations, global equities have rallied since the first banking stress surfaced in the US during March. The MSCI World Index bounced by 6.7%, the S&P500 added 6.4%, whilst the Nasdaq rallied almost 10% (all in USD) since Silicon Valley Bank first announced it was insolvent.

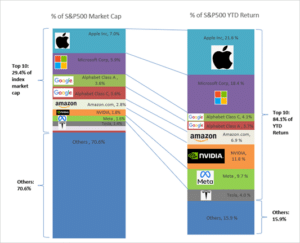

This year’s rally in US stocks has been incredibly narrow and dependent on multiple expansion, with earnings revisions remaining negative. The percentage of stocks outperforming the S&P500 index is now the lowest since 2005. For example, the top 10 stocks in the S&P500 only account for 29.4% of the index weight, however contributed 84.1% of year-to-date returns. This sharp decline in breadth has historically been a signal of elevated risks for large drawdowns or subsequent lower than average returns for the index.

The 2023 equity market rally has been incredibly narrow and dependent on multiple expansions

Source: Bloomberg, 1 May 2023

In addition, the bounce has been largely dependent on multiple expansion with the S&P500 forward Price/Earnings ratio expanding to 18.5x, above the long-term average of 17x. Similar movements have been noted across most developed markets, making stocks more vulnerable to any further rate hikes that can compress company valuations.

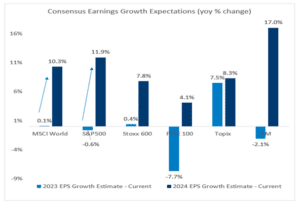

Earnings expectations for 2023 have continued to be adjusted lower across all major indices, reflecting weaker economic momentum. Consensus is currently expecting S&P500 quarterly earnings growth to trough in 1Q23 (-8%yoy) with a steep recovery into 2024 (+12%yoy). There is a renewed focus on credit availability, margins, and forward guidance in response to recent cost cutting programs and banking sector stresses.

On the positive side, the 1Q23 earnings season is off to a good start with companies beating both earnings and revenue expectations. Not just in the US, but also in Europe and Japan. Stock price reactions have however been mixed given the strong run leading up to the earnings season. The key question now is will 1Q23 be the trough and is the market too optimistic about the expected 2024 earnings bounce?

All major markets are expecting a strong rebound in earnings in 2024

Source: Alphinity, Bloomberg, 1 May 2023.

Amid elevated two-sided macro risks, high quality defensive stocks demand a place in a portfolio

Amid heightened macro uncertainty, we believe a diversified portfolio of high-quality companies with idiosyncratic investment cases offer investors a level of protection against unexpected market moves. Two defensive darlings that continue to demand a position in our portfolio are global consumer conglomerates, McDonalds, and PepsiCo.

McDonald’s Corporation (MCD) – One of the most impressive brands and franchises in the world

McDonald’s is one of is the largest restaurant chains in the world by sales and the leading burger fast food chain, with a mostly franchised system spanning over 120 countries. In our view, MCD is one of the most impressive brands and franchises in the world and management’s execution is second to none.

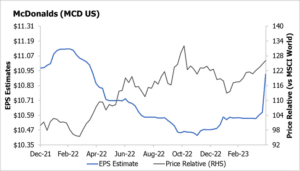

Despite volatility in global markets, MCD delivered another excellent set of results with both 1Q23 sales and earnings beating consensus expectations. Global same-store sales growth increased by 12.6% on strength across all segments and adjusted operating margin expanded by 290bps to 46%. In addition, management reiterated their FY23 guidance despite their expectation of a mild recession as they remain “laser focused on executing on strategic growth pillars.”

MCD is up 12.2% year to date and currently trading at an all-time high share price. In our view there are four main reasons behind MCD’s impressive performance:

1) MCD has been able to pass through price increases while maintaining volume growth;

2) MCD has shown impressive execution on its strategic initiatives in areas like Drive Thru and Digital;

3) MCD is a truly global business with geographic diversification driving results across quarters; and

4) MCD continues to develop and roll out memorable marketing campaigns (such as celebrity meal). This helps keep the McDonald’s brand fresh and appealing to a wide range of customers.

MCD – Enjoying strong earnings upgrades on stronger growth and continued execution

Source: Alphinity, Bloomberg, 1 May 2023.

PepsiCo (PEP) – Global leader in drinks and snacks with a durable top line growth strategy

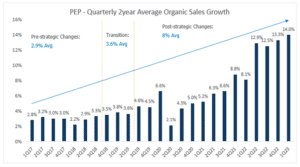

PepsiCo is a leading global beverage and convenient food company with a complementary portfolio of brands, including Lays, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker and SodaStream. We believe Pepsi offers consistency and predictability to a portfolio with a best-in-class management team executing on a proven strategy to deliver sustainable higher organic sales.

PEP also recently reported a very impressive 1Q23 result, with same store sales growth of 14.3% across key categories and regions and comparable EPS up 16%, both beating consensus estimates. Importantly, this emboldened management to raise its 2023 guidance for organic sales growth to 8% (vs 6% previously) and core constant currency EPS growth to 9% (vs 8% previously). Earlier in April, PEP also announced a target of making 100% of its packaging recyclable, compostable, biodegradable, or reusable by 2025.

In our view, PEP remains very well positioned to deliver sustainable long-term growth through:

- Continued focus on productivity and cost savings initiatives ($1bn p.a. savings run rate target);

- Significant reinvestments back into its business including, digitalization, capacity and marketing;

- Enviable brand portfolio, owned distribution network and superior supply chain (that ensures it will have the right and affordable products available when & where needed).

- A mix shift to higher growth snacks business and increased capacity; and

- Best in class management team executing on a clear long term growth strategy.

Like McDonald’s, PEP is up 5.5% year to date and is trading at an all-time high share price.

PEP has a strong track record of delivering accelerating organic sales growth

Source: Company data, Morgan Stanley Research.

Conclusion

Global equity markets have been very resilient year to date, despite the US banking sector scare and ongoing confirmation of weakening macro momentum. On the on hand, the rally has been incredibly narrow and dependent on multiple expansion rather than stronger earnings growth. On the other, the current earnings season is off to a good start and stocks have traded more in line with fundamentals than macro trends.

In this environment of conflicting macro signals and heightened risks, high quality defensive darlings, such as McDonalds, and PepsiCo, offer important characteristics to a diversified global portfolio.

Alphinity is the manager of ASX listed ETFs: XALG and XASG. For more information head to www.alphinity.com.au.