Blair Hannon, Head of Investment Strategy, Global X Australia

With runaway inflation, a record-breaking flu season, and NSW’s government teetering, investors may be forgiven for having missed CSIRO’s once-in-a-decade report on Australia’s future.

In the report, entitled Our Future World, the national science agency identified several “megatrends” that will shape all our lives in the coming decades.

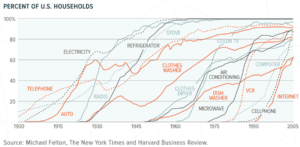

Megatrends are long-term structural shifts that transform economies and societies forever. They usually experience “S-curve” adoption: first there is a time lag in their uptake; then soon they are everywhere.

Examples from previous decades include the creation of cars. Cars gave people unprecedented freedom and killed the horse-drawn cart industry. But cars also created the modern geography of cities. Highways, suburbs, and shopping centres only exist thanks to motorised transport.

Technology adoption across the United States

Television is another example. TV was first introduced in Australia in 1956. Yet by the mid-1970s it was in virtually every household. The TV revolutionised entertainment. But also had profound cultural impacts. Many credit TV with triggering the 1960s feminist movement and the rise of rock and roll.

CSIRO believes there are seven megatrends confronting Australians right now. They are:

- Global warming

- Energy transition

- Healthcare and ageing populations

- The rise of AI

- Digitalisation of the economy

- Geopolitical tensions

- Human dimension

Of these, CSIRO believes that most that the most important are global warming and relatedly the energy transition. Global warming is a threat – throwing up droughts, bushfires, and rising sea levels. It also provides an opportunity as it creates urgent incentives to improve our world for the better.

However the agency also notes that technological change – especially the rise of robots, AI and more of the economy moving online – are fundamental as well.

Investors reading CSIRO’s report may think this is all well and good. But naturally ask what megatrends like these have to do with their portfolios. The answer is that megatrends can contain huge growth potential and make attractive investment opportunities. Those who arrived early to the PC revolution in the 1970s reaped a windfall. So too did those who arrived early to biotech in the 1980s. It seems at the very least possible that something similar is happening now in renewable energy and disruptive technology.

Historically few ways to buy megatrends

For all the potential that megatrends may offer, those wanting to invest in them have historically had few good options.

One option was for investors to do their own research. They could then try to identify a megatrend and pick stocks within it. But the problem with picking stocks for megatrends is you have to be right several times. Right about the megatrend, right about the stocks, right about the best time to buy and sell. The chance of being right every time is low.

Alternatively, investors could pick sectors that align with a given megatrend. For example, investors wanting to invest in artificial intelligence could pick an information technology sector fund. The problem here is that the official sectors – as codified under GICS – are broad, backward-looking, and slow-moving. It took the real estate industry 17 years to get classed as an official sector, only getting added to GICS in 2016.

Introducing thematic ETFs

Thematic investing – such as thematic ETFs – aims to step into this void. It offers investors an easy way to access megatrends and the growth potential they offer. But equally importantly, thematic investing offers investors a way to do this without the risks around stock picking and market timing.

The way they work is that they find a megatrend – including those tapped by CSIRO – and then isolate discrete business activities within it, that are likely to benefit. They can be thought of like sector ETFs in some respects, but more refined and forward-looking.

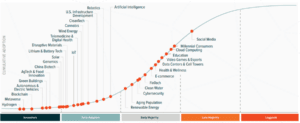

Popular thematics and adoption stage

To give some examples for CSIRO’s megatrends, thematic ETFs may target the energy transition by investing in hydrogen or battery companies. Or seeing the digitalisation of the global economy, thematic ETFs may target robotics or semiconductor businesses. More examples of thematics and their phases of adoption are in the chart above.

Thematic ETFs in Australia

It’s still early days for thematic ETFs in Australia. Under Global X’s classification there are just 22 thematic ETFs on Australian exchanges, with roughly $2.2 billion in assets. This puts it in sharp contrast to the US, where there are almost 300 thematic ETFs with more than $175B under management. (Putting things in perspective, there was just $127 billion in the whole Australian ETF industry on 1 August, according to ASX data).

But if megatrends continue unfolding, and investors continue taking notice, then we should expect the market here to continue growing as well.

For anyone interested in more opportunities Global X’s US listed thematic ETF menu is available by contacting [email protected] or telephone 02 9182 0500.

Notice to residents of Australia

Issuer

This document is issued by Mirae Asset Global Investments (Australia) Limited ACN 610 455 813 (“MAGI AU”), the holder of Australian financial services licence number 484816. The interests in Global X funds are issued by Global X Funds (“Global X”) which is a corporate authorized representative (number 001293527) of MAGI AU. Global X Management Company LLC is the advisor to Global X. Neither Global X nor Global X Management Company LLC have caused the issue of this document to any persons in Australia.

Wholesale Clients only and risk

The offer or sale, or invitation for subscription or purchase, of the interests in any Global X funds (“Interests”) referred to in this document and any other document or material in connection with any funds may not be circulated or distributed, nor may the Interests be offered or sold, or be made the subject of any invitation for subscription or purchase, whether directly or indirectly (including by way of resale), to any person in Australia other than persons who meet the requirements of the definition of “wholesale client” as defined in the Corporations Act 2001 (Cth) (“Corporations Act”) and to whom disclosure is not required under Chapter 6D or Part 7.9 of the Corporations Act. An investment in any fund is subject to investment and other known and unknown risks, some of which are beyond the control of the issuer of the fund, including possible delays in repayment and loss of income and principal invested. Neither MAGI AU nor its related entities, directors or officers give any guarantee as to the success of any fund, amount or timing of distributions, capital growth or taxation consequences of investing in such fund.

General advice only

This document does not take into account investment objectives, financial situation, taxation position and needs of any particular person so it may not be applicable to your circumstances. An investment in a fund should be regarded as speculative and may not be appropriate for all persons or entities. Before you make any financial decision about a fund, including whether to invest in a fund, you should seek professional advice from a suitably qualified adviser. You should consider your financial circumstances and needs and the other relevant offer documentation (“Offer Document”) for any fund before making any investment decision. You can access Offer Documents for Global X funds from MAGI AU by emailing [email protected]. Any person who receives or reads this document should not consider it as a recommendation to purchase or acquire interests in any fund. To the extent that information in this document constitutes financial product advice, it is general advice only.

Not a prospectus or product disclosure statement

This document is not a ‘prospectus’, ‘product disclosure statement’ or any other form of formal ‘disclosure document’ for the purposes of Australian law. This document has not been and will not be lodged or registered with the Australian Securities and Investments Commission (“ASIC”). Accordingly, this document is not required to, and does not, contain all of the information which would be required to be set out in a product disclosure statement or a prospectus.