By David Steinthal, Chief Investment Officer, L1 Capital International

Introduction

Every time you catch a flight, you probably don’t spend a huge amount of time thinking about whether the plane you are sitting in was bought or leased by the airline. Yet this is an important decision for the airline management team. Aircraft leasing is a well-established, but highly specialised niche of the secured asset lending industry. There are a wide range of aircraft leasing capital providers, but publicly traded aircraft lessors are limited, and the sector is not well known outside of the industry. While AerCap is by far and away the largest participant in the aircraft leasing industry, we believe it is flying below the radar of most investors.

It is not often you can invest at an understated tangible book value and a single digit P/E ratio in a business:

- With an industry leading position,

- Supported by drivers that will reliably sustain growth for many years,

- Led by the industry’s best management team,

- Generating strong returns on equity invested in the business,

- Holding an investment grade credit rating, and

- Paying a dividend and returning excess capital to shareholders through buybacks.

AerCap is a top 10 holding in the L1 Capital International Fund and we believe it currently presents a very attractive opportunity to generate strong, compounding investment returns over time.

AerCap Overview

AerCap’s history traces back to the 1970s and the company has been publicly listed since 2006. However, there was a step change in the scale of AerCap’s operations through the acquisition of International Lease Finance Corporation (ILFC) from AIG in 2014 for $28 billion, and the acquisition of GECAS from GE for $30 billion in 2021.

AerCap owns 1,465 passenger aircraft, 69 freighter aircraft, manages nearly another 200 passenger or freighter aircraft, owns over 400 and manages another 600 aircraft engines, and also owns over 300 helicopters for good measure. These aircraft and related assets have a combined book value of around $60 billion. AerCap also has forward orders to purchase over 300 aircraft as well as engines over the next few years for a total additional investment approaching $20 billion. The fleet is a mix of makes and models, have a relatively young average age of around 7 years (weighted by book value) with new technology aircraft accounting for over 70% of the existing fleet. Average utilisation for the owned aircraft in the fleet is 98%.

Travel demand has recovered while aircraft and engine supply are constrained

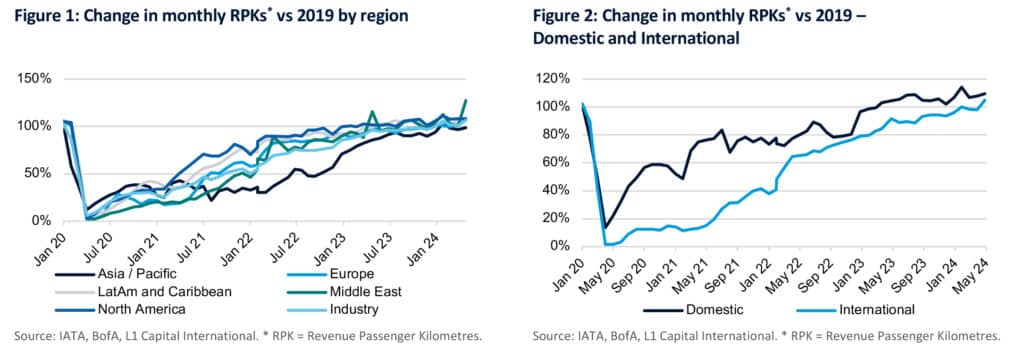

During the COVID pandemic the airline industry effectively shut down and airlines went to ground, literally. However, passenger traffic is now ahead of pre-COVID levels, led by domestic travel.

Boeing, and to a lesser extent Airbus, have struggled to return production levels to pre-COVID levels due to a host of well-publicised operational issues. It is estimated around 2,200 narrowbody aircraft will not be delivered for the period 2019 to 2024 compared to 2018 delivery levels, and over 1,000 widebody aircraft will not be delivered for the period 2020 to 2024 compared to 2019 delivery levels. It is not a case of just a delay in production, these planes will never be built. Furthermore, industry production issues are likely to persist well beyond 2024.

With demand recovering ahead of supply, and supply likely to be constrained for a while, you don’t need to be Alfred Marshall to work out that aircraft lease rates have been increasing. In addition, the cost of the aircraft to an airline, even at current higher aircraft values or lease rates, is small relative to the cost of employees or fuel. Having enough aircraft, or what the industry calls ‘lift’, is critical to an airline’s operations. But wait, there’s more…Not only is there a structural shortage of aircraft, but there is also a structural shortage of engines.

Unlike Airbus and Boeing, which are incentivised to maximise earnings by selling more aircraft, the oligopolistic aircraft engine industry operates under the quintessential ‘razor-razorblade’ economic model where new engines are sold at losses, with profit made over the 20 plus year useful life of the engine through aftermarket maintenance. This means engine manufacturers benefit from engines having a longer useful life and more service revenue and are less incentivised to maximise production of new engines.

Today there a large number of grounded aircraft awaiting serviced engines. Commercial aircraft don’t work very well without engines (the industry parlance is a ‘Glider’) and recently, Airbus downgraded its aircraft delivery guidance in part due to engine supply chain issues. Catching up on the backlog of engines requiring maintenance and spare parts is likely to take a few years.

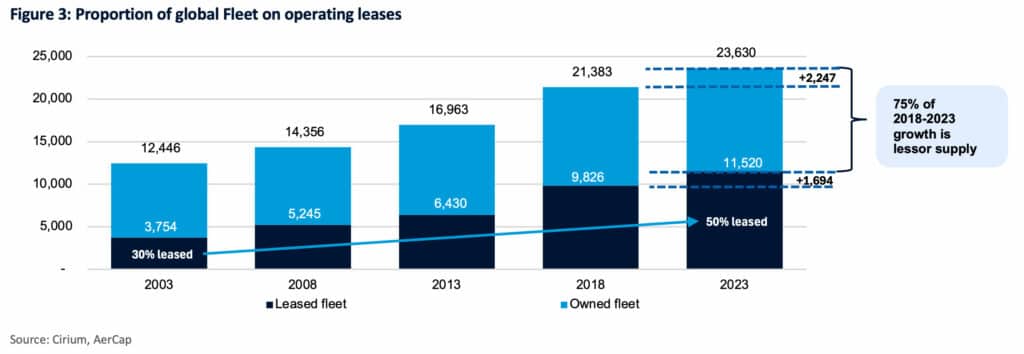

Over the past 20 years, due to a range of advantages, leasing companies have increased their share of the total global fleet from 30% in 2003 to 50%, with 75% of the global fleet growth over the past 5 years supplied by lessors.

AerCap’s multi-faceted competitive advantages

Not only are lessors in general gaining share of the global aircraft fleet, but we believe AerCap, as the largest and most diversified aircraft leasing company, is best placed to optimise returns on equity invested in its business and deliver strong returns to shareholders. AerCap management has identified seven areas that drive its competitive advantages and to deliver superior returns through the life cycle of an aircraft:

- Financing – cost of financing is critical for any financing business. Having a strong investment grade credit rating as well as greater scale and diversity of operations lowers AerCap’s debt financing costs relative to most other lessors, as well as many airline customers, most of which do not have an investment grade credit rating. AerCap’s credit rating was recently upgraded by both Moody’s and S&P.

- Purchasing – The aircraft leasing business is as much about capital allocation as it is about operational matters. AerCap management has added significant shareholder value by making industry transforming acquisitions at low points in the cycle, as well as committing to buy aircraft from Airbus and Boeing when airlines were being cautious. In the current environment where aircraft values have increased due to supply and demand pressures, we expect a greater proportion of AerCap’s cashflow to be directed to share repurchases.

- Specification – The buying decision is not simply the headline price paid for an aircraft, but also detail such as the terms agreed with the manufacturer and fit-out costs. AerCap has the experience and breadth of operations to not just focus on the initial lease of a new aircraft, but also to consider how to maximise the value of the aircraft over its total life, including subsequent leases or sale.

- Leasing – With over 300 airline customers around the world, AerCap has the scale and expertise to tailor transactions to meet the needs of a broader range of customers and their leasing requirements, while managing risk and return.

- Maintenance – Over an aircraft’s useful life, the cost of maintenance exceeds its upfront purchase price. While airlines are usually responsible for aircraft maintenance, AerCap still needs to ensure the maintenance is done properly and, in some instances requires the airline to reserve cash to fund future maintenance in case they get into financial difficulties. Minimising the downtime of an aircraft will maximise its value. AerCap has the ability to move aircraft and engines around so that the downtime of its fleet is minimised.

- Transitions – There is a constant need to reposition aircraft from one airline to another since some airlines may only want new or near new aircraft in their fleet. AerCap’s management has done this 300 times since 2021, and in so doing managing certification and other regulatory issues, fit out and avionics. AerCap has in-house part-out capabilities (i.e. retiring an aircraft and selling off its component parts), as well as a cargo aircraft business and has selectively converted passenger aircraft to cargo aircraft to maximise their value. Over time, appropriately transitioning aircraft during their economic life maximises returns on capital invested.

- Trading and End-of-Life – The decision to sell an aircraft, re-lease it, or part it out is made aircraft by aircraft to maximise total lifetime value, not near-term earnings. AerCap has sold 1,600 aircraft over the past 18 years and has consistently received a premium to book value overall.

To the above seven points, we add an eighth, being risk management.

AerCap’s business model is systematically built around risk management. It starts with working with the right lessees, and extends to lease term construction, minimising receivables, requiring reserves for maintenance and other expenses when required, financial and technical surveillance and the procedures and capabilities to respond when a lessee has difficulties, including repossessing aircraft which AerCap has done over 200 times from over 65 airlines.

Consistently strong financial performance

AerCap should be considered a financing company which requires assessment of leverage, funding and liquidity. It is not hard for a financing company to grow. There are plenty of people and businesses that will take your money if you offer to lend it to them. They just might not pay you back. Likewise, there are plenty of airlines that will happily lease an aircraft from you for a low rental or other favourable lease terms. They just might not pay the lease, and/or maintain or even return your aircraft. Growing purely to be bigger is unlikely to deliver strong investor returns.

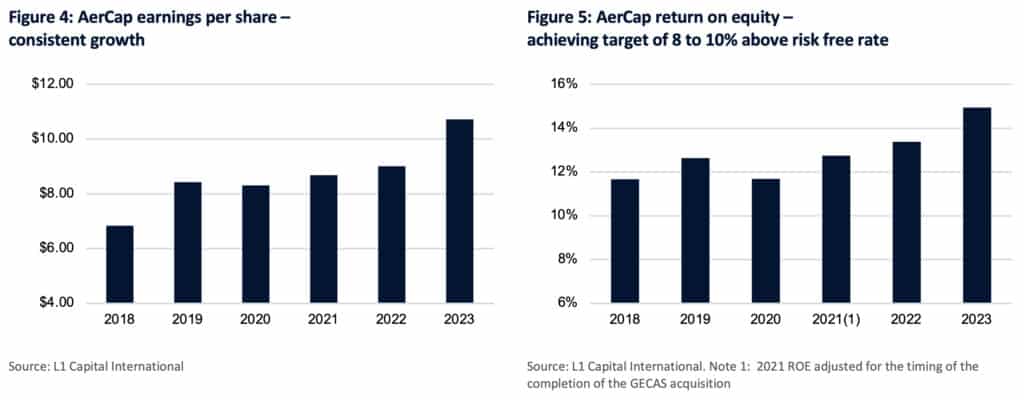

In our view, AerCap management has demonstrated the right balance between growth and returns on equity invested in the business, through prudently allocating capital and managing risk.

Attractive valuation, and even more ‘hidden value’

AerCap is trading on a forward P/E ratio of around 8x and 1x tangible book value. In other words, at the current price, we are investing at the net equity value of the aircraft owned by AerCap and are paying no goodwill for a business that has consistently delivered returns well above its cost of capital, and which is run by an exceptional management team, operating from a position of competitive strength in an industry with sustainable long term growth drivers.

But wait, there’s still more… We believe AerCap’s tangible book value of around $90 per share is materially understated:

- GECAS was acquired for $30 billion in 2021, funded with both equity and debt. Management estimates they acquired the assets at a $3.3 billion discount to market value, or around $15 per AerCap share.

- Aircraft values have increased materially in recent times. The tight supply and demand conditions are leading to both increased lease rates and higher aircraft values when sold. Every 5% increase in market value of aircraft above book value also adds around $15 to AerCap’s tangible book value per share.

- When Russia invaded Ukraine, AerCap and many other lessors had a number of aircraft in Russia. Effectively the Russian airlines and authorities stole these aircraft from the lessors and AerCap was forced to record a $3 billion write-down of these assets, resulting in zero book value for these aircraft. Subsequently there have been partial settlements with the Russian authorities and airlines and AerCap has recovered $1.3 billion. AerCap remains in discussions with the Russian authorities as well as pursuing litigation against its insurers to recover the balance of the losses. We believe further recoveries are likely and represent additional value of $5 per share or more that is not reflected in tangible book value.

- AerCap has commitments to purchase around $20 billion of aircraft and engines over coming years. It is unusual to consider commitments to spend money as a source of value, but in the current world of acute aircraft shortage we believe the ability to secure aircraft from Airbus and Boeing, even if delayed, represents an additional source of value. Many of these aircraft are already committed to airlines at agreed lease rates, which does temper any additional value to AerCap.

Outside of unusual events such as COVID-19 and the Russian situation, AerCap has consistently realised net gains on sale when it sells aircraft. We expect AerCap will continue to realise a premium to book value when it divests aircraft.

Our unique definition of ‘Quality’, detailed industry knowledge and consistent focus on Value has highlighted a compelling opportunity to invest in AerCap. We have continued to add to our investment in AerCap over the past 3 months, with AerCap now being a top 10 holding of the L1 Capital International Fund.

This article is general information and does not consider the circumstances of any investor or constitute advice. Material published in SIAA Newsroom is copyright and may not be reproduced without permission. Any requests for reproduction will be referred to the contributor for permission.