By Ross Pullen, Senior Director, Head of Product Development, Cboe

One of the central principles underpinning capitalism is the idea that a free market is the most efficient way for an economy to allocate resources (capital) and set prices (based on supply and demand). It’s what makes capitalism, capitalism.

Day-to-day though, stock exchanges and stockbrokers make this happen by offering two (2) things:

- capital raisings, e.g. IPOs or placements (allocation of capital or resources), and,

- trading and clearing (setting prices). Clearing is the under-appreciated star here. Sure, trading provides price formation, but clearing is the reason that price is formed without having to care about who the investor on the other side of your trade is (or if they can pay or deliver the share promised).

Cboe quietly announced the world’s first global capital market in early 2023. The full impact of this won’t be seen for years, but the benefits for Australian business will be easy to see. It’s a natural evolution for a growing exchange that already lists close to 1,900 ETFs from more than 110 issuers and 80 corporate securities from over 55 issuers.

Starting with capital raisings

When a business owner wants to sell his or her lifetime’s work (e.g. the business he or she started and spent 40 years building up), one of the best ways is an IPO.

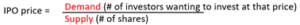

The price they get for selling their lifetime’s work is a simple function of supply and demand.

Supply is fixed. It’s the company they’re selling (e.g. 100 shares).

Demand is variable though.

They could go to ASX and access Australian investors for capital. That’s a population of >26mm investors who can participate in the IPO.

They could go to NYSE and access American investors. That’s a population of >335mm investors who can participate in the IPO.

Cboe’s vision is to have an aligned rule framework between each country so that a company meeting listing requirements in Australia will materially meet exchange requirements in the other countries. This means that once a company lists on Cboe, it will already materially meet exchange requirements to raise capital in the USA, Canada, UK, Europe and Australia (subject to regulatory approval).

More countries, means more investors – meaning a better IPO price.

So that individual selling their lifetime’s work in an IPO can sell their business to >1.2 billion people on Cboe or just one country for about the same amount of exchange work.

All other things being equal, a global market means more investors. More investors means a better price for that individual selling their lifetime’s work in an IPO.

A business owner only gets one chance to sell their business. They’ll only get paid once. Wouldn’t it be better to offer that IPO to as many investors as possible to get a fair price?

Cboe wants to do things differently. Building on its Canadian ‘ESG Disclosed’ positive impact heritage, Cboe is consciously focusing on supporting a purpose-driven economy and building companies that shape tomorrow positively.

The immediate difference here and now though is simply that it’s a global exchange and a domestic exchange can’t match the access to investors that it offers.

Capital raisings just became a global opportunity. A world-first that inherently means better prices for anyone trying to sell their business in an IPO.

Moving on to price formation (secondary or on-exchange trading)

Once an IPO lists, it’s still important that there’s continued demand or the traded price will drop (impacting that company’s ability to raise further capital at a fair price).

Nothing changes with Cboe’s advantage here.

A Cboe company that raises capital in the UK will be able to be made available for trading in other countries.

Shares of a company in the other countries will be fungible with those in Australia. Meaning investors will be able to buy in Australia but sell in the US, UK, CA or EU if they wanted to.

A Cboe-listed company will be traded around the globe with the same share trading in the UK & Europe, then Canada/USA, before opening in Australia (and the whole thing repeating again).

Global price formation for Cboe-listed corporates is already happening. Canadian/USA Cboe companies are already trading overnight in the EU and Australia is planning to go live in 2024.

A global capital market might not sound like a big deal. However, the impact from Australian businesses having access to global capital markets will be a really big change. Access to global capital will mean more business opportunities approved, more projects built, more people hired and a better chance of improved prosperity for everyday Australians (probably a couple of stockbrokers too).

*Cboe’s global capital market framework in Australia is subject to regulatory approval.

Ross Pullen (Senior Director, Product Management APAC Listings) leads product development efforts to launch new markets at Cboe Australia, joining the organisation in October-2015. Prior to joining Cboe Australia, Mr Pullen led the AQUA team at the Australian Stock Exchange where he was responsible for ETF, Managed Fund, Hedge Fund & Warrant markets and ASX BookBuild. His background includes >16 years stock exchange experience and uniquely, he either led or was a member of teams which launched both of Australia’s ETF markets.