Rohan Reddy, Director of Research at Global X.

With aggressive timelines to reach net-zero carbon emissions and global energy consumption expected to increase by 50% through 2050, governments are exploring all options in the next generation of power production.1 While much of the focus has been on renewables like solar and wind, there may still be a critical role for nuclear energy in the global energy mix, given that it’s clean, reliable, and yes, safe. Importantly, nuclear power is gradually shedding the stigma attached to it, helped by significant improvements in technology and safety measures.

Nuclear power can help achieve clean energy transition goals

Meeting the world’s growing power needs while simultaneously reducing carbon emissions presents difficult challenges for policymakers. Compounding the issue is finding ways to power the 55% percent of the world’s population living in dense urban areas.2 While proven renewables like solar and wind are becoming increasingly economical, their larger footprint, intermittent power production, and difficulty in rapidly scaling requires other clean solutions to diversify the world’s energy mix.

Similar to solar and wind, nuclear fission reactors produce no greenhouse gas emissions during operation. But even when accounting for total carbon emissions (such as in the building of a nuclear power plant or solar panels) they have lower carbon emissions than many other renewables.

Nuclear is also more dependable than many other power sources as well. Renewables like solar and wind depend on variable climate conditions to power their panels and turbines, and at many points through the day and year may not produce much energy at all. Conversely, the U.S. Energy Information Administration (EIA) reports that nuclear operates at full capacity 93.5% of the time, making it the most reliable energy source by far.

Governments continue to embrace nuclear power

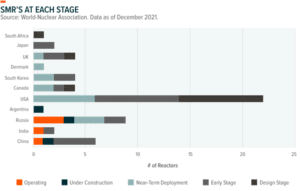

Changing technology has also led to innovation in this space. Small module reactors (SMRs) are the most prominent example of these new reactor types. SMRs have all the benefits of traditional nuclear power plants, but they require less planning and capital needs than their traditional counterparts, making them particularly suitable for smaller energy projects.

Globally, over 50 reactors (traditional and SMR) are under construction in 19 different countries. With 445 reactors in operation around the world today, these new builds represent meaningful growth for nuclear power.5

Supply deficit could support higher uranium prices for longer

Uranium provides the fuel to nuclear power plants. But many of the world’s largest uranium miners tapered production or shuttered mines completely as the global economy came to a standstill at the start of the pandemic. These decisions flipped a deeply oversupplied market into one that quickly became undersupplied. Now with demand increasing, the supply deficit is unlikely to dissipate soon due to the uranium production cycle.

Unlike other commodities, uranium requires a longer and more extensive production timeline. Utilities must source uranium 12–24 months before its expected use. Producers like Cameco and Kazatomprom, which together represented 28% of global uranium production in 2020, are not expected to increase production for the next 1–2 years.4 That timeline suggests the earliest we can expect materially higher production output is between 2024 and 2026, which could provide support for higher prices in the short term.

Positive momentum for uranium’s long-term investment case

We believe that sustained political buy-in and financial support from governments means nuclear is here to stay, particularly as demand for clean and reliable energy grows.

For investors many do not seek exposure to uranium through the less liquid futures market, but rather through ETFs, individual equities or spot market purchases. ETF investors and institutional investors like hedge funds are also signalling bullish uranium price dynamics which is observed via flows data across these markets.

Key takeaways

- Nuclear power emits zero greenhouse gas emissions during operations, making it a viable energy option for net-zero climate ambitions.

- Nuclear production is more reliable than other renewables, and large population centres with rising energy needs like China and India are taking notice.

- With supply deficits expected to persist, leading indicators like ETF flows suggest that investor sentiment towards the uranium market is bullish.

Individual stocks also potentially offer somewhat of a levered play on the underlying commodity price, given the high fixed costs associated with mining. For this reason, we believe investing in uranium through the Global X Uranium (URA) ETF available on NYSE ARCA may provide a more diversified and cost-effective method for accessing a diverse basket of companies involved in uranium mining activities around the world.

Footnotes

- EIA Report. “EIA projects nearly 50% increase in world energy use by 2050, led by growth in renewables”

- United Nations. “UN World Urbanization Prospects”. Data as of November 2019.

- IAEA. “What are Small Modular Reactors (SMRs)?”

- World Nuclear. “World Uranium Mining Production”. Data as of September 2021.

Disclaimer

Notice to Australian residents

This document is issued by Mirae Asset Global Investments (Australia) Pty Ltd ACN 610 455 813 (“MAGI AU”), the holder of Australian financial services license number 484816. The interests in the Global X Uranium (“Fund”) are issued by Global X Funds (“Global X”) which is a corporate authorised representative (number 001293527) of MAGI AU. Global X Management Company LLC is the advisor to Global X. Neither Global X nor Global X Management Company LLC have caused the issue of this document to any persons in Australia. The Fund is available in Australia only to persons who are “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) and accordingly this document is not intended to be received or read by anyone other than a wholesale client.

An investment in the Fund should be regarded as speculative and may not be appropriate for all persons or entities. To the extent this document contains any financial product advice, it is general advice only. This document does not take in to account the investment objectives, financial situation, taxation position and needs of any particular person.

Before investing in the Fund you should carefully assess whether the acquisition of the interests in the Fund is appropriate in light of your own investment objectives, financial circumstances and needs (including, but not limited to, financial and tax issues) and seek independent professional advice.

If you have any queries or complaints please contact an Australian representative at [email protected].