By Markus Mueller, Co-Founder, Australian Bond Exchange

Executive Summary

- More and more SIAA members are being asked by their clients about investing in bonds.

- Attractiveness to investors and advisers driven by a legally binding income stream and offering great diversification for the typical investment portfolio.

- Bond market participation is set to increase due to improvements in technology that help reduce transaction costs and changes in regulation.

- Lower costs and portfolio reporting capabilities provide advisors with visibility over portfolios making the asset class directly comparable to equities from an operational perspective.

The Australian Bond Market – it’s bigger than you think!

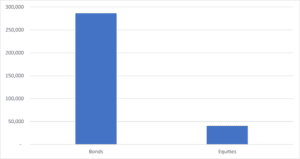

The bond market issuance dwarfs the equity primary issuance. By value, bond issuance was A$286.4 billion compared with A$40.6b in equity capital raised by ASX listed entities (Figure 1).[1]

More recently, the Australian Bond Exchange started identifying bonds from quality international companies and bringing them into Australia in Australian dollars. This means a much more diverse selection of bonds are now available selected from a significantly greater number of companies from across the globe.

Figure 1: Value of new bond and equity Issues, Financial Year 2021 (A$B)

[1] ASX FY2021 Annual Report

Historical under-investment in bonds

As a quirk of Australian history, lack of general accessibility to the bond market, combined with the favourable tax treatment of property investment, equity dividends and hybrid securities has influenced investment decisions. Both private investors and their advisers decide their portfolio construction and management at least in part because of this favourable tax treatment rather than appropriate risk and return considerations.

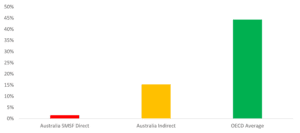

Private investors and self-managed superannuation funds (SMSFs) in Australia appear underweight bonds when compared with allocations of private investors globally. Australian SMSFs held only 1.46% of their assets in bonds, superannuation funds held 15.2% compared to the 44.2% average across Organisation for Economic Cooperation and Development (OECD) countries.[1]

Figure 2: Australian direct bond investment as proportion of SMSF assets and total retirement investments compared with OECD average investment in fixed income for retirement

[1] https://www.oecd.org/finance/private-pensions/pensionmarketsinfocus.htm

The OECD data also shows that Australian private investors and SMSFs are correspondingly significantly overweight domestic equities and domestic unlisted property.

The incentive to invest in riskier asset classes at the expense of a more balanced investment portfolio potentially jeopardises investors’ ability to achieve appropriate portfolio risk/return settings and their desired investment outcomes. As clients get older, they rely more in a secure income stream than they do capital growth. Hence a rebalancing of portfolios in sync with age is a good strategy for members.

Growth of the retiree

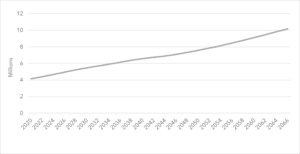

The average Australian is getting older. The Australian Bureau of Statistics data projects an increase in the proportion of the Australian population aged 65 years and over from four to over 10 million over the next 30 years (Figure 3).

Bonds are well suited to the retirement income needs of an ageing population. Most portfolios can benefit from increasing allocations to bonds as a compelling alternative to heavy allocations to equities and property as part of a balanced investment portfolio with lower volatility. Especially as older investors rely on the consistent income and are unable to rebuild from a market crash compared to younger investors.

Figure 3: Estimated Increase in proportion of population aged 65+ years[1]

[1] Source: ABS Population Projections, 2017

Interest rates have moved up after a period of historically low rates – providing opportunity

With the recent moves by the RBA to lift interest rates, the returns on corporate bonds are more attractive than they have been for years. The Australian interest rate market has already factored in more rises and that is now being reflected in the pricing of Australian bonds.

Globally the interest rate yield curves are beginning to inverse – showing lower rates in the future compared to now. Now is the time to take advantage of Australian dollar denominated corporate bonds before the local interest rate market falls in line with the rest of the world.

Be early in getting access to this untapped opportunity

The barriers to entry to the bond market for investors is being broken down. With new products, transparent pricing, a number of public policy initiatives to promote broader market access, and the subject of a parliamentary inquiry into the Development of the Australian Corporate Bond Market.

This inquiry has recommended broad changes including adjusting the taxation system (#11), increasing tax incentives for bonds (#10), remove barriers to investment (#12), ASIC to review financial ratios (#7), and changing the bond issuance process for greater access (#3, #5). These changes are positive and can solve many of the above problems.

With the changes that are being planned, and the tremendous opportunity, now is the best time to start investigating how the changes in the bond market will impact you and your clients.

[1] Source: ABS Population Projections, 2017