By Blair Hannon, Head of Investor Strategy, Global X

Whilst interest rate rises are putting pressure on markets, a positive is that the conversation around accessing income in a portfolio gets easier. We know that fixed income, especially of long duration, has been an extremely tough space to invest in upon the lead up, and during this rate rising cycle. While cash, for the first time in a long time, is now providing a level of returns, it is still unlikely to be able to provide adequate income for investors, especially those in self-managed super funds (SMSFs). Thankfully, we have continued to see healthy equity dividends.

Drawing upon the experience in the United States, Global X ETFs has seen advisers supplementing these dividends with covered call strategies to outsize their income flow. Although covered calls can be run at an individual portfolio level and that customisation can be beneficial for many clients, for some it can be time consuming and create greater risk due to the knowledge required to run the strategy. There is an opportunity for investors to run a covered call strategy through an index-based fund like an ETF which removes the complexity and individual risk, while still providing an adequate income boost from using this strategy.

Global X ETFs has been running covered call strategies across the major US indices such as Nasdaq, S&P500, Dow Jones and Russel since 2013 and experienced the performance of this strategy in both steady and volatile markets.

How they work, using Nasdaq 100 Covered Call ETF (QLYD) as an example –

QYLD’s covered call position is created by selling a monthly at-the-money index call option against the stocks in the Nasdaq 100 Index (NDX) that the Fund simultaneously buys (or already holds). As a refresher, an option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price (strike price) within a certain period or on a specific date. In return for the sale of the call option, the Fund receives a premium, which can potentially provide income in sideways markets and limited protection in declining markets. Importantly however, the Fund gives up that profit potential if the index rises above the strike price of the index call option.

Index options refresher

- Expire at the end of the month

- Unlike single stock options that can be exercised at any time, index options cannot be called/exercised early

- Settle in cash, not in delivering the underlying index holdings

- Higher index volatility can lead to larger premiums

QYLD’s covered call-writing process:

- QYLD buys all the equities in the Nasdaq 100 Index

- Simultaneously, QYLD sells Nasdaq 100 Index options that will expire in one month to a counterparty in exchange for a premium.

- At the end of the month, QYLD seeks to distribute a portion of the income to its shareholders from writing/selling the NDX index option

- At the beginning of each new month this process is repeated

Since the index options cannot be called early, it only matters where the index finishes for the month. Prior to expiration, all market swings that take place throughout the month don’t matter.

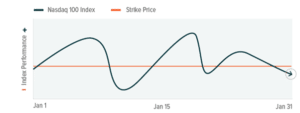

For example, see a market that is volatile during the month

In the illustrative example below, the Nasdaq 100 Index ended the month below the call option strike price. Therefore, QYLD which sold the call option would potentially benefit from the premium received. This may offset some of the decline in the underlying equity holdings.

Covered call strategies can provide a measure of protection

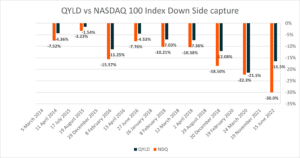

QYLD performed better than the underlying Nasdaq 100 Index during certain large drawdown events, this includes the current draw down being experienced across the index at present.

Source: Bloomberg, 17/6/2022, Performance data quoted represents past performance and is no guarantee of future results. Portions of the distribution may include a return of capital. These do not imply rates for any future distributions. The ETF is not required to make distributions. Nasdaq 100 is QYLD’s broad market benchmark.

Covered call strategies can also thrive in volatile markets

In volatile markets, option premiums are likely to rise, and therefore, covered call strategies tend to perform best in choppy or sideways markets rather than in major bull or bear markets. While markets remain volatile now once they settle in an L shaped recovery, covered calls could help outperform flat markets.

Although covered call strategies can be implemented on a variety of indexes or underlying assets, selling calls on the Nasdaq 100 offers distinct advantages. Historically the NDX has consistently exhibited higher volatility than the S&P 500, which can fuel greater income from selling options. NDX volatility averaged 21.71% over the last five years, compared to 18.11% for the S&P 500.

In summary

Covered call strategies, such as the Global X Nasdaq 100 Covered Call ETF (QYLD), could be a beneficial strategy for investors in uncertain environments. Higher volatility tends to increase the options premium received from selling calls, which can enhance returns even in a trendless market. In addition, the income from tech-based covered call strategies can help diversify an income portfolio away from traditional sources, like dividend paying stocks or fixed income.

Disclaimer: Notice to residents of Australia

This document is issued by Mirae Asset Global Investments (Australia) Limited ACN 610 455 813 (“MAGI AU”), the holder of Australian financial services licence number 484816. The interests in the Global X Nasdaq 100 Covered Call ETF (“Fund”) are issued by Global X Funds (“Global X”) which is a corporate authorised representative (number 001293527) of MAGI AU. Global X Management Company LLC is the advisor to Global X. Neither Global X nor Global X Management Company LLC have caused the issue of this document to any persons in Australia.

Investing involves risk, including the possible loss of principal. Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector. Investors in QYLD should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses.

QYLD engages in options trading. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed upon price within a certain period or on a specific date. A covered call option involves holding a long position in a particular asset, in this case U.S. common equities, and writing a call option on that same asset with the goal of realising additional income from the option premium. QYLD writes covered call index options on the Nasdaq 100 Index. By selling covered call options, the Fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. A liquid market may not exist for options held by the Fund. While the Fund receives premiums for writing the call options, the price it realises from the exercise of an option could be substantially below the indices current market price. QYLD is non-diversified. The information provided is not intended for trading purposes, and should not be considered investment advice.

Wholesale Clients only and risk

This document and any other document or material in connection with this document may not be circulated or distributed to any person in Australia other than persons who meet the requirements of the definition of “wholesale client” as defined in the Corporations Act 2001 (Cth) (“Corporations Act”) and to whom disclosure is not required under Chapter 6D or Part 7.9 of the Corporations Act.

General advice only

This document does not take into account investment objectives, financial situation, taxation position and needs of any particular person so it may not be applicable to your circumstances. Any person who receives or reads this document should not consider it as a recommendation to purchase or acquire interests in any fund. To the extent that information in this document constitutes financial product advice, it is general advice only.

Statements, opinions and estimates provided in this document are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, MAGI AU and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions. Investments are subject to investment and other known and unknown risks.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s summary or full prospectus, which may be obtained by calling 02 9182 0500, or by visiting etfs.globalxetfs.com.au. Please read the prospectus carefully before investing.