By John Forwood, Chief Investment Officer of Lowell Resources Funds Management Pty Ltd

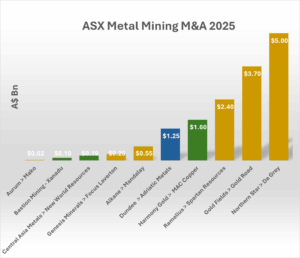

The first half of 2025 has seen an upsurge in metal mining mergers and acquisitions on the ASX. This has coincided with record gold prices and an upturn in share prices in the gold sector, after several years in the doldrums. Is there more to come and where will it happen?

Upswing in gold mining M&A activity

The first six months of 2025 have seen A$15bn in metal mining sector takeovers closed or announced on the ASX, focused on precious metals and copper. Gold projects in WA have dominated the scene. The largest acquisition has been the $5.0bn takeover by Australia’s biggest gold producer Northern Star, acquiring De Grey Mining, owner of the 11million ounce Hemi gold deposit in the Pilbara of WA.

WA gold has also seen the agreed $3.7bn takeover of Gold Road Resources by Gold Fields Ltd, its 50% partner in the Gruyere gold mine, while serial-acquirer Ramelius Resources has negotiated a $2.4bn takeover of neighbouring Spartan Resources in the Mt Magnet district. The latter is a remarkable come-back, after Spartan (formerly Gascoyne Resources) sank into voluntary administration in 2019.

Turning to silver, the “other precious metal” or “gold’s poor cousin”, most recently Dundee Precious Metals has bid A$1.25bn for Adriatic Metals (“the Big Bosnian”) which has recently commissioned the Vares-Rupice silver-base metal mine in the Balkans.

ASX copper sector being “hollowed out”

The copper sector has also seen significant activity, with the predators coming from offshore. South Africa’s Harmony Gold has made a $1.6 billion bid for Mac Copper, the ASX-listed owner of the CSA copper mine in NSW. And little-known London-listed Central Asia Metals has bid A$185m cash for New World Resources. New World is developing the ‘Antler’ copper-base metal project in Arizona, and looking to benefit from expedited permitting under Trump, which is a long-term challenge in the USA. Singapore based Bastion Mining has also bid for Mongolia-focused copper developer Xanadu Mines.

This has left the cupboard rather bare in terms of ASX-listed copper players. Aside from the majors in BHP which owns giant copper mines such as Olympic Dam and Escondida (57% ownership), and Rio (with its interest in Escondida and Oyu Tolgoi), and then the A$5bn Sandfire Resources, there is little local copper content on the ASX. Looking down the bourse the next local players would now be companies such as Aeris Resources or AIC Mines, both sub-$200m market caps!

What has driven the M&A Activity?

In the first instance, the surging gold price has triggered the growth in M&A activity in the metals mining sector. The US$ gold price hit record highs of over US$3,500/oz in April this year, and is up around 13x since Gordon Brown famously sold the Bank of England’s bullion in 2000. The gold price increased at an average of 8% annually in the 25 years from 1999–2024. And ironically it is now central banks, particularly the Chinese as they push towards “de-dollarisation”, which are the largest buyers of gold. In fact, the ECB has recently reported that in 2024 gold overtook the euro as the world’s second most important reserve asset for central banks. Bullion accounted for 20 per cent of global official reserves in 2024, outstripping the euro’s 16 per cent and only behind the US dollar at 46 per cent.

Ever-depleting mining reserves, due to limited exploration success as a result of increasingly costly and time-consuming land access, means that acquisition will be the major component of a gold or copper producer’s growth story. Of course, as prices rise, low-grade rock which a miner previously classified as uneconomic or ‘waste’, can become profitable ore (all other things being equal).

With rising metal prices, and moderating cost escalation (particularly in key operating cost inputs such as fuel and labour), gold miners’ margins have exploded, and their cash balances have followed. This has enabled cash or largely-cash bids to be tabled for their inorganic growth programs.

What’s next?

The gold price shows no signs of substantial pull-backs, and so gold miners will continue growing their cash piles (and share prices). Of course, other uses of funds such as returns of capital, hedge-book buy backs and project development will consume some of the cash. But the pipeline of junior companies with attractive operating or near-development assets will continue to attract the swollen wallets of the bigger goldfish.

In copper, the number of ASX-listed names are dwindling fast, in contrast to say Canadian listed stocks with their myriad of copper projects in North and South America. And valuations in the Canadian market remain cheaper than on the ASX. So it is likely base-metal M&A activity will be relatively stronger in Toronto and Vancouver than Perth.

Note: the Lowell Resources Fund was a shareholder in De Grey Mining, Gold Road Resources, Adriatic Metals, New World Resources and Ramelius Resources. The Fund’s current top holdings are WA gold developers Astral Resources and Medallion Metals.