Provided by Fidelity International

It’s been ‘one step forward, two steps back’ for investors just recently – every piece of positive news on the markets is followed in short order by something else to shut down hopes once again.

Take a look at the always-important US market in recent weeks. The S&P 500 rose by two per cent on 13 October 2022 and then a further one per cent during early trading the next morning. But then came some worse-than-expected news on US inflation and everything slammed into reverse, with the index ending 14 October 2022 a whopping 2.5 per cent lower for the day overall.

Then, on the following Monday, it was all change again as the S&P jumped back 2.65 per cent after some more encouraging news on company earnings. Shares rose again on Tuesday but then retreated on Wednesday and Thursday as worries mounted about the impact of a still strong US jobs market on interest rates in America.

It is clear investors are on maximum alert, hyper-sensitive to any news they consider will set the direction for shares for the next few months. By common consensus, we are at a potentially important inflection point.

Markets have fallen in anticipation of an economic slowdown and much higher interest rates, but recession is yet to arrive, and rates still have a long way to climb. Are markets now poised to rebound – or is this just a stopping-off point on the way to much deeper falls?

The history of previous downturns holds lessons that could help answer that question.

Markets can begin to recover when the economic news is at its worst

There seems little doubt that economies are slowing – the likelihood of recession has moved from ‘possible’ to ‘probable’. And that reduced economic activity will translate, sooner or later, into lower company earnings.

But those things don’t have to translate into market falls. That’s because stock markets tend to move in advance of overall economic growth and even the earnings of companies. In a sense, this is the job of markets – to anticipate likely company performance ahead of time and position themselves accordingly.

It’s a point made in a recent report by Goldman Sachs, which dissects stock market performance during previous bear markets – defined as those which have suffered a 20 per cent fall from their recent peak.

The analysis of historical data found that bear markets turn back into bull markets typically while economies are still in recession. That means markets can turn positive even when economies are shrinking because they have already processed that bad news and are anticipating the upturn that follows.

Specifically, it found that bull markets tend to begin 6-9 months before the low-point for earnings around 3-6 months before the low-point for economic growth.

Mapped onto the current situation, that means markets could begin to climb again even when the economic and company news remains very negative.

Returns tend to be biggest during periods of recovery

Stock markets don’t deliver their returns in a smooth way. The average annualised return of the S&P 500 since its inception in 1957 is around 11 per cent – but that has come in fits and starts with some years losing money and some gaining much more than that level. Please remember past performance is not a reliable indicator of future returns.

In particular, markets tend to grow more quickly in periods after they have been depressed, and slower after they have already risen. According to a study this year by the Wells Fargo Investment Institute, returns in the S&P 500 in the 12 months following the end of a bear market have averaged 43.4 per cent.

We don’t know how long the current bear market will last, of course. The average length of bear markets according to the same Wells Fargo research is 10.8 months, with the average loss in that time being 35.5 per cent. Were the current bear market to follow those averages then it will be well into next year by the time the tide turns – but the returns from then would also be worth waiting for.

Diversification has helped portfolios recover in the past

While the headlines about markets tend to focus on indices like the FTSE 100 or the S&P 500, the reality is that most investor portfolios will include a much greater spread of assets.

That’s a sensible strategy because a mix of different assets has tended to provide returns that are less extreme during downturns. And there may be some evidence that more diverse portfolios also help during market recoveries. The Wells Fargo report examined returns during bear markets from a diversified portfolio – comprising bonds, commodities, small cap stocks and emerging market stocks alongside the main US market – versus those from just the S&P 500 alone.

It showed that, on average, historically a diversified portfolio fell by less – around 18 per cent versus 37 per cent – and recovered in less time – under a year, on average – after a bear market than the S&P 500 Index (just under two years).

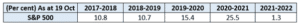

Five-year performance

Source: FE from 19 October 2017 to 19 October 2022 Basis: Total returns in GBP. Excludes initial charge

________________________________________

Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Any comments or statements made are not necessarily those of Fidelity. Fidelity is a registered trademark licensed to various companies in the FIL Limited group.