By David Steinthal, Chief Investment Officer, L1 Capital International

Jacobs Solutions (Jacobs) was founded in 1947 by Joseph Jacobs as a one-man chemical engineering consulting business. Over the next nearly 80 years the business has grown through international expansion and strategic acquisitions to become one of the largest engineering design firms globally with over 45,000 employees.

Today, Jacobs is a focused, capital-light, technology-forward provider of engineering services concentrated on higher-growth, higher-margin markets such as infrastructure, water, advanced manufacturing and life sciences.

Sustained long-term growth drivers

Jacobs’ leading market positions in the secularly growing Critical Infrastructure, Water & Environmental Solutions, and Life Sciences & Advanced Manufacturing sectors are expected to support mid-single digit-plus revenue growth.

Critical infrastructure

Global infrastructure renewal remains a key priority. In the U.S., the US$1.2 trillion Infrastructure Investment and Jobs Act (IIJA) is still in the early stages of deployment and expected to underpin infrastructure spend growth for years. Much of America’s core infrastructure was built in the mid-20th century with the American Society of Civil Engineers highlighting in its 2025 Infrastructure Report Card the need for substantial modernisation investment. This is a pattern mirrored globally.

The U.K. Treasury has committed £725 billion over 10 years to national infrastructure renewal, while in Australia the Government has committed to a 10-year, $120 billion Infrastructure Investment Program. Jacobs holds leading market positions in the transportation, airports, highways and mass transit subsegments, and is deeply embedded in delivering these large-scale programs.

Water and environmental

Rising climate volatility, water scarcity, aging infrastructure, urbanisation and shifting demographics are driving sustained investment in water systems and environmental resilience.

The American Society of Civil Engineers estimates a US$3.7 trillion gap between current planned infrastructure investments and what must be spent to have U.S. infrastructure in good working order.

Growing complexity combined with concerns over emerging contaminants, increasing instances of system failures and worsening risk assessments (dams are on average 64 years old in the U.S.) will support increased engineering consulting spend in wastewater treatment, water supply and water transmission segments where Jacobs holds market leadership positions.

Life sciences and advanced manufacturing

Structural demands driven by aging populations, chronic disease growth and the need for innovation, are catalysing investment in life sciences manufacturing. Jacobs is ranked #1 globally in pharmaceutical facility design, having supported clients like Pfizer and AstraZeneca in scaling vaccine production, and Eli Lilly and Novo Nordisk in delivering GLP-1 therapies.

The CHIPS Act, as well as President’s Trump’s carrot and stick approach to encouraging domestic semiconductor manufacturing is also driving investment in the U.S., including the $100 billion capex commitment by TSMC. Jacobs is also the #1 ranked firm in data centre and semiconductor facility engineering, having designed over half of the world’s advanced fabs. The company is currently partnering with NVIDIA on implementing a digital twin solution to improve the design, simulation, deployment and operation of AI factories. Jacobs services also extend to power requirements, wastewater systems and data centre liquid cooling, all critical to support the development of next generation AI infrastructure.

Critical, specialised knowledge and successful track record leads to entrenched client relationships

Engineering advisory services play a pivotal role in shaping major infrastructure and construction projects, despite typically representing a small portion of a project’s total cost. These engagements are often complex, multidisciplinary and high stakes, acting as the fulcrum upon which project performance, cost and risk balance. Consider the construction of a bridge: the engineering solution must address technical challenges (e.g. geotechnical analysis, structural design, digital modelling), logistical and operational constraints (e.g. traffic forecasting, construction staging), environmental compliance and stakeholder alignment. Given the consequences of failure, ranging from safety risks to cost overruns and reputational damage, the selection of engineering consultants is driven more by specialised expertise, track record and delivery capability than price.

Underappreciated margin expansion potential

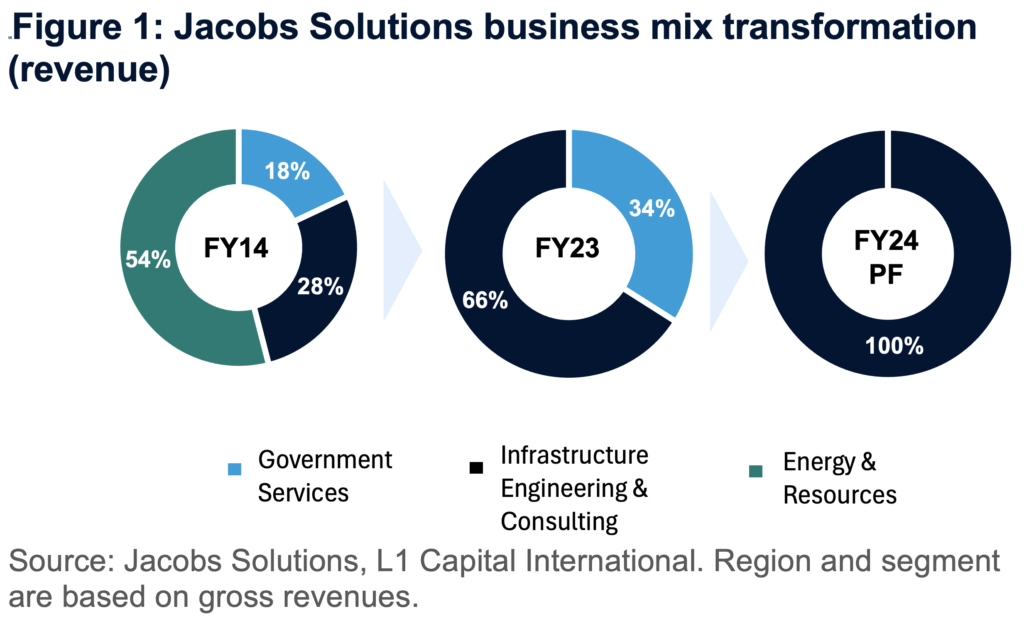

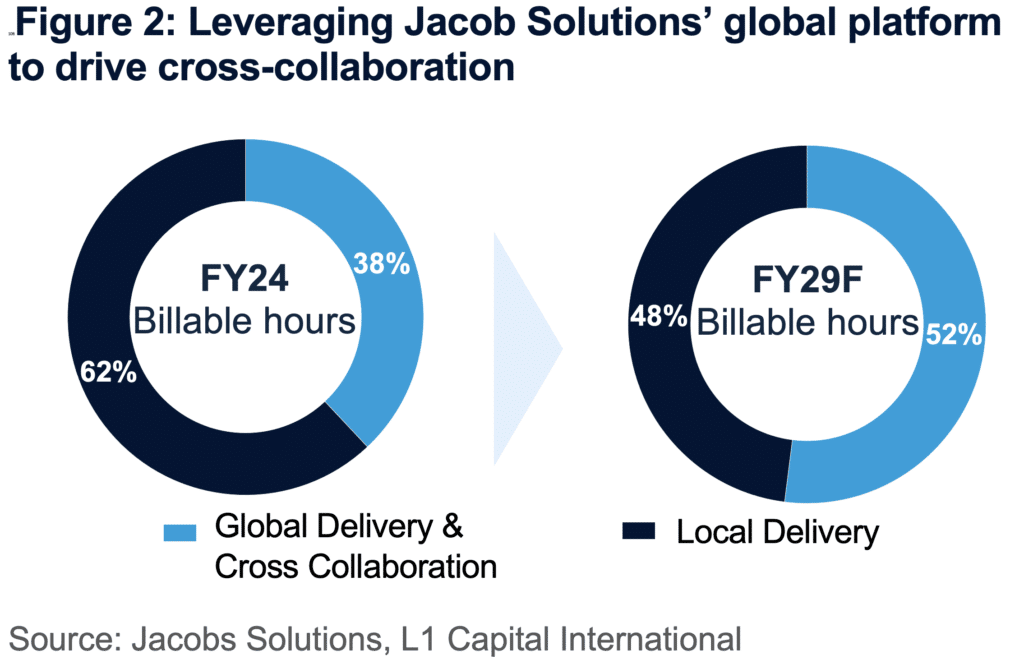

Jacobs is well positioned to expand margins meaningfully following the simplification of its business model and operational structure. Following the government services divestment, the company is now focused on a streamlined engineering services portfolio. There is a clear path to margin expansion through several credible levers in addition to operating leverage through:

- Global delivery centres

- Digital and AI productivity

- Commercial model innovation

- Favourable mix shift

Attractive valuation

Jacobs has a solid balance sheet with strong free cashflow and portfolio optimisation reducing net debt. The company has an investment grade credit rating. Looking forward, capital allocation has been simplified, with management committing to return at least 60% of free cash flow to shareholders through dividends and share repurchases.

Sustained industry growth tailwinds, leading market positions, a well-defined margin expansion plan and shareholder returns combine to support our base case for Jacobs to deliver double-digit earnings per share growth over the medium term.

Jacobs is currently trading on a 19x forward P/E ratio, around a 5% free cashflow yield and offers a 1% dividend yield. We consider these valuation metrics undemanding, with the potential for Jacobs’ market valuation to close the gap compared to listed peers such AECOM, Stantec and WSP.

We believe Jacobs is well positioned to deliver strong returns to shareholders.

| Key service providers for the Fund are: Responsible Entity – Equity Trustees Limited, Fund Administrator and Fund Custodian – Apex Group, Fund Auditor – EY, Legal Advisor – Hall & Wilcox. There have been no changes to key service providers since the last report.

* There must be positive absolute performance (adjusted for distributions) in the performance period. Otherwise, positive relative performance carries forward to next Period. This article is general information and does not consider the circumstances of any investor or constitute advice. No fund or stock mentioned in this article constitutes an offer or inducement to enter into any investment activity. Material published in SIAA Newsroom is copyright and may not be reproduced without permission. Any requests for reproduction will be referred to the contributor for permission. |