By Aaron Viscayno, Business Development Associate, Investment Products, ASX

It’s been an eventful financial year in the investment products space at ASX across exchange traded funds (ETF) and listed investment vehicles (LIV).

ETFs in focus

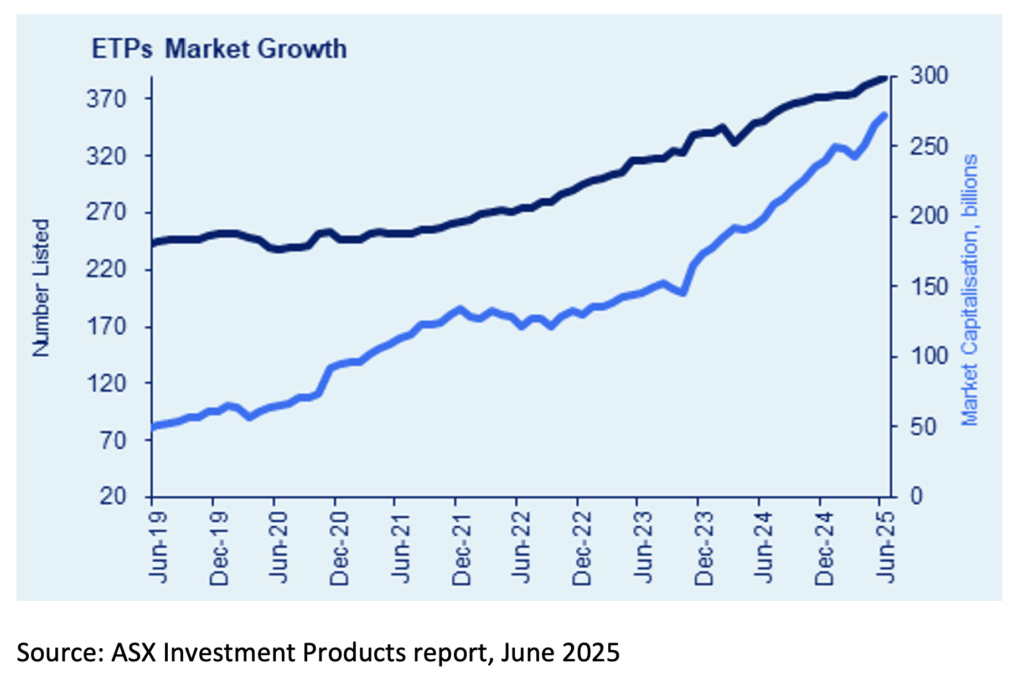

The demand for ASX ETFs continues to grow, with the market cap reaching over $272bn (an increase of 36% year-on-year).

https://www.asx.com.au/issuers/investment-products/asx-investment-products-monthly-report

A total of six issuers made their debut on ASX in the past financial year:

- DigitalX (ASX:BTXX)

- Lanyon Asset Management (ASX:LNYN)

- Daintree Capital (ASX:DCOR)

- Martin Currie (ASX:R3AL)

- ClearBridge (ASX:CIIH,CUIV,CIVH)

- First Sentier (ASX:LEVR)

50 new ETFs were listed of which 28 are active, following the trend from last year where new active strategies outnumbered passive.

One standout thematic gaining traction is within defence. Over the months of September and October last year, VanEck (ASX: DFND), Betashares (ASX: ARMR) and Global X (ASX: DTEC) all listed passively managed defence themed funds which stood out amongst the top performers for the first half of 2025[1].

A number of our ETF partners also reached notable milestones over the past year. iShares by BlackRock, known by many investors as a passive fund manager, launched their first active ETF in Australia with the iShares U.S. Factor Rotation Active ETF (ASX: IACT). Similarly, Global X – being more renowned for their thematic and commodity-based funds – listed the Global X Australia 300 ETF (ASX: A300), giving investors the opportunity to invest in a core allocation. A300 is Global X Australia’s first broad Australian equities ETF, joining the largest and most competitively priced ETFs available on ASX.

Innovation in the ETF market

ETFs have continued to evolve to meet the needs of investors here in Australia. Arguably, some of the most high-profile ETF launches of the last financial year came from the cryptocurrency space. Their arrival on ASX has garnered the attention of many investors looking for exposure to crypto, without the cumbersome practice of handling multiple crypto exchanges or digital wallets. VanEck (ASX:VBTC) were first to admit a Bitcoin ETF on ASX, launching in June 2024. DigitalX (ASX:BTXX) followed shortly after in mid-July. Betashares also listed a duo of crypto ETFs in February this year, tracking the performance of Bitcoin (ASX:QBTC) and Ether (ASX:QETH).

On the fixed income front, the Betashares Defined Income Bond ETF range (ASX: 28BB,29BB,30BB) represent the first of its kind here in Australia. With set maturity dates, investors have exposure to a diversified corporate bond portfolio whilst providing stable, monthly cash payments, with certainty of principal repayment upon maturity. Upon maturity, investors have the option to roll into a new defined income ETF to keep their investment strategy on track[2].

Listed Investment Vehicles (“LIVs”)

We have seen a resurgence in the LIV sector in the past year. Prior to the listing of the Pengana Global Private Credit Trust (ASX:PCX) in June 2024, the last LIV IPO was back in October 2022. Since the start of the last financial year, a total of six LIVs have listed on ASX, with capital raised exceeding $1.5bn. Secondary capital raised also saw a marked increase – $2bn in FY25 compared to $1.5bn in FY24[3].

Newcomers, La Trobe Financial, came to market with the La Trobe Private Credit Fund (ASX:LF1), reinforcing the use of the LIV structure as way for investors to get exposure to the Private Credit asset class. Metrics expanded their listed offerings to cover Australian and New Zealand commercial property with the Metrics Real Estate Multi-Strategy Fund (ASX:MRE).

Industry stalwarts and newcomers alike listed LIVs with an income directive. Whitefield (ASX: WHI) and Wilson Asset Management (ASX: WMX) amongst the veterans, alongside newcomers Realm Investment House (ASX:DN1) and MA Financial (ASX: MA1).

Keeping to the subject of income, APRA’s announcement to phase out the $43bn hybrid securities market in December 2024 is being met by a number of new listed products to fill the void. In addition to the LIVs mentioned above, the first Challenger IM Listed Floating Rate Term Security (Challenger IM LiFTS 1 Notes, ASX: CIMHA) is being launched giving investors the opportunity to invest in an ASX-listed unsecured note, providing a blended portfolio of actively managed private and public credit[4].

Momentum continues to build in the investment products market at ASX. Constant transformation and innovation in newer products will continue to provide Australian investors and advisers the ability to construct diverse portfolios conveniently, across many different asset classes and investment strategies. To stay up to date with all of the latest data in the investment products space – including FUM flow, total funds under management and new launches, check out the ASX investment products monthly report.

[1] https://www.investordaily.com.au/markets/57442-defence-and-precious-metals-top-etf-charts-in-first-half-of-2025

[2] https://www.betashares.com.au/insights/smarter-fixed-income/

[3] Source: ASX internal documents

[4] Source: https://www.challengerim.com.au/funds/challenger-im-lifts-1-notes/