SIAA accredited CPD webinars are offered free to Principal, Practitioner and Affiliate members. Content will be delivered via panels, interactive discussion, presentations and quizzes and to be eligible for CPD you will need to participate in the webinar live.

Under the bonnet of Listed Income Funds

Wednesday 25 February from 1.00 to 2.00pm AEDT

Investments are not all the same and this is particularly so with listed income funds, where asset held within structures can differ along with how income is delivered to investors. In this webinar, hear from three listed income funds holding different assets under the closed-end structure of a LIV (LIC or LIT) on how they are structured to deliver consistent income over the long-term and why the LIC or LIT structure they use is suited for their particular income strategy.

Ian Irvine, CEO, Listed

With a career spanning close to 50 years, Ian has experience in sales, marketing and business development. He has worked in the financial services arena since 1986, with time at Westpac, AMP Bank and 14 years at ASX to December 2017. He has been Chief Executive of the Listed Investment Companies and Trusts Association since January 2018. He holds a B. Com (UNSW) and has been a members and trustee of a self-managed super funds since 1996.

Matt Barca, Fund Manager – Income Credit, Qualitas

Matt is Fund Manager, Income Credit, with responsibility for managing the daily fund operations including assisting with capital allocation and portfolio curation. He has over 18 years of experience in institutional banking, structured finance, and relationship management within financial institutions. Most recently, Matt worked as an Associate Director in the Capital Structuring and Securitisation team at Commonwealth Bank. Prior to that he held roles in relationship management and as a credit analyst within Commonwealth Bank and worked in financial services at Deloitte as a Chartered Accountant.

Damien Boey, Portfolio Strategist – Wilson Asset Management

Damien has over 20 years’ experience in investment and central banking, and was previously an equity strategist at Barrenjoey Capital Partners, following 15 years at Credit Suisse as an economist and macro strategist, and four years at the Reserve Bank of Australia across foreign exchange and international financial markets. Consistently ranked among Australia’s top three for economics and strategy research, Damien has developed predictive modelling tools spanning asset allocation, sector and style rotation, foreign exchange, macroeconomics and fixed income.

Thomas Choi, Senior Portfolio Manager, Perpetual

Thomas is a Senior Portfolio Manager in the Credit & Fixed Income Team. He has over 15 years of experience covering structured credit, including RMBS, CMBS, ABS, CLOs, and private warehouse investments. Thomas has managed Perpetual’s enhanced cash portfolios for more than a decade and oversees cash management across Perpetual’s boutique asset management teams. Before joining Perpetual, he held roles in derivatives, convertible bonds, and hybrid securities trading and analysis.

Professional standards CPD: 1.0 Technical competence

ASIC RG146: 1.0 Generic knowledge

Webinar – Under the bonnet of Listed Income Funds

Student Affiliate Member: $0.00

Organisation Member: $0.00

Non-Member: $75.00

Member-Practitioner: $0.00

Introduction to Stockbroking Workshop

Thursday 5 March from 11.00-1.15pm AEDT

Australia’s financial markets are among the most sophisticated and well-regulated markets in the world. Central to the operation of efficient markets is the role of stockbrokers. This workshop provides an overview of Australia’s financial markets and the critical role that stockbrokers play both in retail and institutional markets. A high-level view of stockbroking and financial advisory operations including order taking, transaction and settlement will provide insight into the different systems involved and allow for a discussion of the different business models in stockbroking today.

Russell McKimm MSIAA

During his 40+ year career in stockbroking Russell has held a number of senior management positions in leading broking firms as well as providing advice to a wide range of clients. He has also been involved in numerous industry bodies including President of the Financial Planning Association of Australia (now FAAA) and board member of Stockbrokers Association (now SIAA). He has always had a passion for educating clients which he has fulfilled by being a lecturer in many industry courses and through his commitments including his talkback radio program on 2GB.

Professional standards CPD: 1.0 Regulatory compliance and consumer protection | 0.5 Technical competence | 0.5 Professionalism and ethics

ASIC RG146: 1.0 Generic knowledge

Register four or more (Organisation Member or Non-member) by Thursday 26 February 2026 and receive a $50pp discount. Email [email protected] to register four or more.

Introduction to Stockbroking Workshop

Student Affiliate Member: $55.00

Organisation Member: $150.00

Non-Member: $200.00

Member-Practitioner: $100.00

A Day in the Life of a Trade Workshop

Monday 9 March from 11.00-12.30pm AEDT

An excellent refresher for experienced staff and perfect for those in auxiliary roles (eg legal, IT, HR and other supporting roles associated with stockbroking), this workshop delves deep into the day of a life of a trade. You will walk away with a solid understanding of client onboarding processes, the process of share and derivative trades from order placement through to execution to settlement, sponsorship/HINS, CHESS messaging, registries and more.

Rob Talevski, CEO, Webull Securities

Rob joined Webull Securities, a Fintech empowering individuals to become life-long investors, as its CEO in November 2021. Prior to this he was the Responsible Manager who led the trade execution business of Australian Investment Exchange (AUSIEX). With over 18 years’ experience across retail, wholesale and institutional channels Rob will provide great insight into a day in the life of a trade.

Professional Standards CPD Area: Regulatory compliance and consumer protection 0.75 hour | Technical competence 0.75 hour

ASIC RG146: 1.0 Generic knowledge

Register four or more (Organisation Member or Non-member) by Monday 2 March 2026 and receive a $50pp discount. Email [email protected] to register four or more.

A day in the life of a trade workshop

Organisation Member: $150.00

Non-Member: $200.00

Member-Practitioner: $100.00

Market Manipulation and Other Prohibited Conduct Workshop

Tuesday 10 March from 11.00-1.30pm AEDT

This workshop focuses on the prohibition on creating or maintaining an artificial price for trading in various financial products, including shares and futures. This workshop will benefit all who wish to gain an understanding of markets and the consequences of breaching obligations. Designed to suit the needs of financial market professionals from the front and back office, this is a great opportunity to brush up on your obligations, learn how to protect yourself and understand the difference between manipulation and ordinary market forces.

Professor Michael Adams

Professor Michael Adams is a specialist in Australian corporate law and international corporate governance. Michael has expertise in financial services regulation, information governance, consumer protection and the broader area of legal technology and education. Professor Adams was Dean of Law at Western Sydney Law School from 2007 to 2017 and from 2019 the Head of the University of New England Law School.

Professional Standards CPD Area: 1.25 Regulatory compliance and consumer protection | 1.0 Professionalism and ethics

ASIC RG146: 1.0 Generic knowledge

Register four or more (Organisation Member or Non-member) by Tuesday 3 March 2026 and receive a $50pp discount. Email [email protected] to register four or more.

Market Manipulation & Other Prohibited Conduct Workshop

Student Affiliate Member: $50.00

Organisation Member: $150.00

Non-Member: $200.00

Member-Practitioner: $100.00

CSLR – Where to now?

Wednesday 11 March from 1.00 to 2.00pm AEDT

With the CSLR issuing its estimate for the FY27 levy for an astonishing $137 million that does not even include claims expected from the collapse of Shield and First Guardian things are just getting worse for the financial services sector. Michelle Huckel will provide an update on what sits behind the FY27 levy estimate and whether there is any relief in sight for those expected to pay for it.

Michelle Huckel, Policy Manager, Stockbrokers and Investment Advisers Association

Michelle worked as lawyer specialising in financial services law, IPOs and due diligence for mergers and acquisitions, before taking up the role of legal counsel and compliance manager at Shaw Stockbroking. Michelle previously worked as a policy adviser at Governance Institute of Australia. At SIAA Michelle undertakes research and analysis for the development of advocacy initiatives, provides an early warning system of impending legislative and regulatory issues of relevance to members and represents the association externally with government, regulators and other bodies.

Professional standards CPD: 0.5 Regulatory compliance and consumer protection | 0.5 Professionalism and ethics

ASIC RG146: 1.0 Generic knowledge

Webinar – CSLR – where to now?

Student Affiliate Member: $0.00

Organisation Member: $0.00

Non-Member: $75.00

Member-Practitioner: $0.00

Estate planning under the new super rules

Wednesday 25 March from 1.00 to 2.00pm AEDT

Recent changes to the taxation of member benefits in superannuation have implications for estate planning strategies. This webinar will examine how the Division 296 rules affect death benefit nominations, reversionary pension nominations, taxation outcomes associated with the payment of death benefits and the overall structuring of member balances. Kym will highlight practical considerations for advisers, including common pitfalls and areas requiring proactive client engagement. Attendees will leave with a clearer understanding of the risks, opportunities and key conversations to initiate with clients.

Kym Bailey, Technical Services Manager, JBWere

Kym assists advisers to maintain their strategic technical advice knowledge, enabling them to provide high quality client advice. With over 25 years’ experience in Tax and Superannuation Consulting, as well as ten years as a HNW client Adviser, Kym is able to identify opportunities and translate technical substance into a form that is relatable for others. Kym holds the Chartered Tax Advisor (CTA) and Fellow CPA designations as well as the GAICD. Kym is the Chair of the Tax Institute of Australia’s Superannuation Committee as well as the Author of the SMSF Solutions publication (Thompson Reuters).

Professional standards CPD: 1.0 Client care and practice

ASIC RG146: 1.0 Generic knowledge

Webinar – Estate planning under the new super rules

Student Affiliate Member: $0.00

Organisation Member: $0.00

Non-Member: $75.00

Member-Practitioner: $0.00

SIAA 2026 Conference | Investing in growth and resilience

Tuesday 19 and Wednesday 20 May 2026

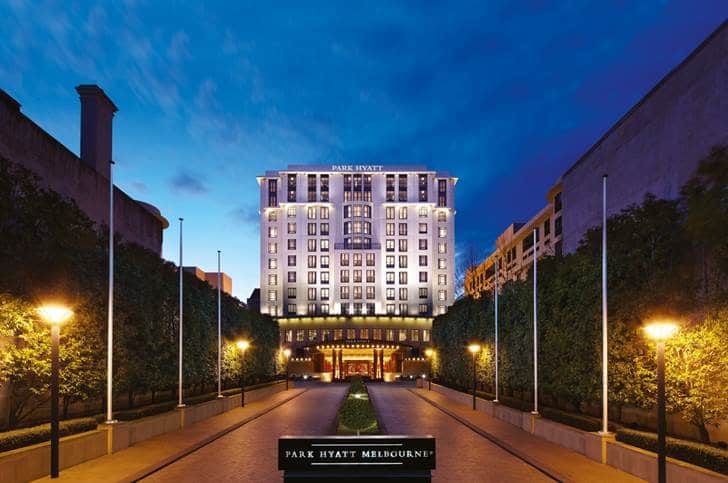

Park Hyatt Melbourne, 1 Parliament Place

Over two engaging days in Melbourne, delegates will exchange ideas, hear from influential voices, and explore the forces shaping the future of our industry. The conference offers practical insights into professionalism, ethics, continuing education, policy developments, regulatory change, and market trends. It also provides valuable networking opportunities, bringing together individuals and organisations from across the sector to spark collaboration. The conference celebrates the vital role advisers and brokers play in Australia’s capital markets.

The Park Hyatt Melbourne is located at 1 Parliament Street, overlooking St Patrick’s Cathedral and Fitzroy Gardens. Each guest room blends art deco elegance with modern comfort and is 48 square metres in size, featuring one king bed and an en-suite bathroom with double vanity. Parliament Station is a three-minute walk from the hotel, and delegates can access discounted parking and accommodation rates. At the close of day one, delegates are invited to unwind and connect at the SecuritEase Networking Drinks, held in the Trilogy Room and Garden at the Park Hyatt.

Register four or more (Organisation Member or Non-member) and receive a $200pp discount. Email [email protected] to register four or more.

Conference Delegate

Student Affiliate Member: $375.00

Organisation Member: $950.00

Non-Member: $1,250.00

Member-Practitioner: $750.00

If you experience any difficulty with your online registration, please call our office on (02) 8080 3200.

Supporters

Thanks to the following organisations who are supporting SIAA’s webinar program during 2025.