By Phil Huber, Head of Portfolio Solutions, Cliffwater

Private debt has become one of the most discussed areas of the investment landscape. Rapid growth and heightened media attention have fueled what we believe is a misguided narrative that often ignores the stability, income potential, and portfolio diversification the asset class has demonstrated for over twenty years. In many cases, these concerns stem from a fundamental misunderstanding of what private debt is and, just as importantly, what it is not.

This paper argues that much of the skepticism reflects a repeated misdiagnosis. Stress and excesses in public credit markets are frequently conflated with private debt, despite meaningful differences in process, incentives, documentation, and risk management. As a result, allocators are often reacting to headlines rather than evaluating lending fundamentals.

To cut through the noise, we introduce a simple framework: The five Ws of Private Debt. By focusing on who the borrower is, what supports repayment, when capital returns, where the lender sits in the capital structure, and why the borrower needs capital, investors can evaluate private debt consistently across corporate, asset-based, and specialty lending. A final section on how risk is managed ties these elements together and highlights the role of structure, alignment, diversification, and manager selection.

Getting Private Debt wrong, again

Private debt has been here before. Periods of growth have historically been followed by warnings of excess and predictions of widespread losses. Yet many of these warnings have failed to materialize as anticipated. The most recent slew of private credit critiques stemmed from comparisons to the broadly syndication loan (BSL) market that blurred important distinctions, generalising lending as a whole. This conflation matters. Private debt is not simply a private version of the public loan market. It is a distinct lending model with different incentives and tools for managing risk.

As we have documented in prior research¹, private debt has been more resilient than the headlines would suggest. Performance has been consistent across multiple stress periods, providing evidence that the dominant narrative has often understated the strength of structure and underwriting in the asset class.

Headline defaults and the source of confusion

A review of recent, widely publicised defaults reinforces the importance of distinguishing between public and private markets. In most cases, the exposures at the center of the headlines were not representative of core private debt strategies, but rather reflected BSL or hybrid structures.

¹Cliffwater Research “Direct Lending’s Wall of Worry” (December 2024)

This matters for the purpose of clarity, not finger-pointing. When outcomes from one market are attributed to another, investors risk drawing conclusions that do not hold up under closer inspection.

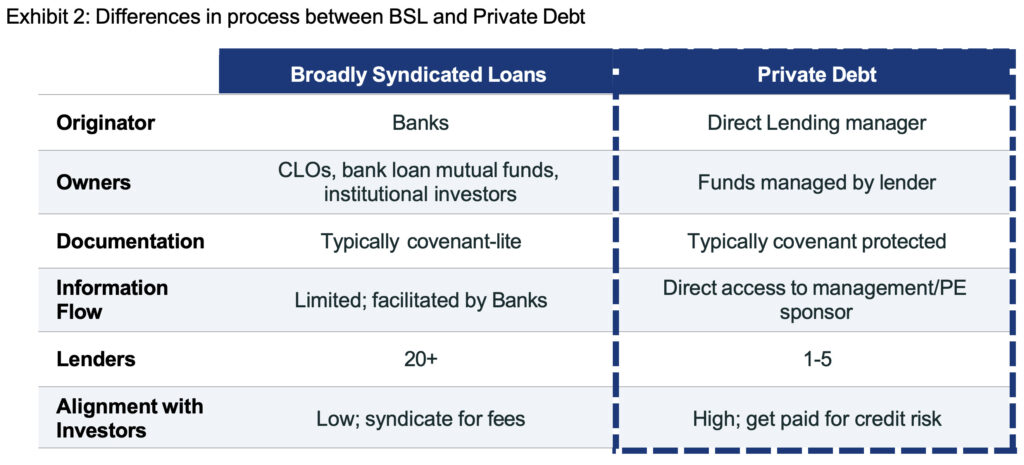

Distinguishing between BSL and private debt helps explain why this confusion persists. While both markets may finance similar borrowers, the process by which loans are originated, owned, and managed differs in important ways.

BSLs are typically originated by banks and distributed to a wide investor base. Documentation has trended toward covenant-lite structures, information flow is intermediated through agent banks, and lender groups often number in the dozens. Incentives in this model are closely tied to origination and syndication activity.

Private debt operates differently. Loans are originated and held by a small number of lenders that expect to own exposures for the loans’ full life. Documentation is typically covenant protected, information flow is direct, and incentives are aligned with long-term credit performance rather than distribution volume. These distinctions do not guarantee superior outcomes in every case, but they materially change how risk is identified, monitored, and managed, particularly during periods of stress.

The five Ws of Private Debt

At its core, private debt is still lending. Regardless of strategy or structure, every private debt investment can be evaluated by answering five basic questions:

- Who is borrowing?

- What supports repayment?

- When does capital return?

- Where does the lender sit in the capital structure?

- Why does the borrower need the capital?

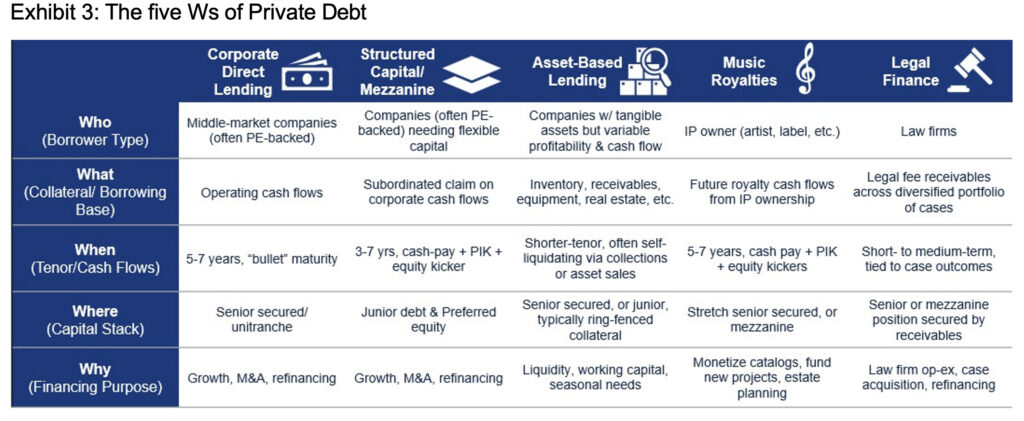

Used together, these questions provide a consistent lens for comparing strategies that might otherwise appear unrelated, including (but not limited to) direct lending, structured capital/mezzanine debt, corporate asset‑based lending (ABL), music royalties, and legal finance.

- Who: Borrower type determines economic exposure. Corporate borrowers are tied to operating performance and business cycles. Asset‑based borrowers are more closely linked to collateral performance. Royalty and legal finance strategies rely on contractual or quasi‑contractual cash flows that may be less correlated with traditional economic growth.

Understanding who the borrower is helps clarify where risk resides and how it may behave under stress.

- What: The source of repayment is central to Cash‑flow lending depends on earnings over time, while asset‑based strategies rely on borrowing bases that are tested and adjusted frequently. Royalty and legal finance strategies depend on diversified contractual payment streams. These differences help explain why strategies with similar headline yields can exhibit very different risk profiles.

The source of repayment anchors underwriting and informs recovery expectations.

- When: The timing of cash flows varies widely. Direct lending and mezzanine loans typically carry multi‑year “bullet” maturities. Corporate ABL is often shorter‑dated and self‑ Royalty strategies amortize over time, while legal finance can range from short‑term advances to longer‑dated case resolutions.

Duration influences interest‑rate sensitivity, reinvestment risk, and liquidity planning. Strategies with faster capital turnover can reprice risk more quickly. Longer-dated strategies require greater confidence in underwriting and structure.

- Where: Position in the capital structure determines priority of payment and Direct lending and corporate ABL strategies are typically senior and secured. Structured capital sits below senior debt but is compensated through higher yields and potential equity participation. Royalty and legal finance strategies often sit outside the traditional corporate stack, with claims tied to ring‑fenced cash flows.

Strategies that appear unconventional may be structurally senior in practice, while others that appear familiar may carry more subordination than expected. Understanding where a strategy sits clarifies how losses would be absorbed if conditions deteriorate.

- Why: Borrower motivation provides important Many borrowers seek private debt for speed, certainty, or flexibility rather than as a last resort. Asset‑based borrowers may be smoothing working capital, royalty holders may be monetizing future cash flows, and law firms may be managing timing mismatches between expenses and settlement payments.

Motivation influences pricing power, structure, and alignment.

How: Risk management and portfolio construction

The Five Ws describe the shape of risk. The final question is how that risk is managed.

Private debt results reflect both the underlying credit exposure and the quality of structure and execution. Ultimately, this is still credit, and not every outcome unfolds as planned. In those moments, the structural choices made at origination often matter most.

Overcollateralization, covenants, cash controls, ring-fencing², and conservative advance rates all play a role in mitigating downside risk. Alignment mechanisms such as sponsor capital beneath the loan, equity participation, or minimum return provisions further influence incentives. Diversification across borrowers, assets, and strategies reduces reliance on any single assumption.

Manager selection is critical because these tools are applied unevenly. Two managers operating in the same segment can produce very different outcomes depending on discipline, concentration, and experience navigating stress.

Conclusion

The private debt debate is unlikely to quiet anytime soon. Heightened scrutiny is a natural consequence of a maturing market.

By focusing on who is borrowing, what supports repayment, when capital returns, where the lender sits, and why the borrower needs capital, allocators can evaluate strategies consistently across a diverse and evolving landscape. When narratives shift but lending fundamentals endure, we believe investors are best served by getting back to basics.

Disclosures

The views expressed herein are the views of Cliffwater LLC (“Cliffwater”) only through the date of this report and are subject to change based on market or other conditions. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Cliffwater has not conducted an independent verification of the information. The information herein may include inaccuracies or typographical errors. Due to various factors, including the inherent possibility of human or mechanical error, the accuracy, completeness, timeliness and correct sequencing of such information and the results obtained from its use are not guaranteed by Cliffwater. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this report. This report is not an advertisement, is being distributed for informational purposes only and should not be considered investment advice, nor shall it be construed as an offer or solicitation of an offer for the purchase or sale of any security. The information we provide does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Cliffwater shall not be responsible for investment decisions, damages, or other losses resulting from the use of the information. Past performance does not guarantee future performance. Future returns are not guaranteed, and a loss of principal may occur. Statements that are nonfactual in nature, including opinions, projections, and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Cliffwater is a service mark of Cliffwater LLC.

² Ring-fencing is a structural feature in which assets and related cash flows are legally segregated from the broader operations of the borrower, often through special purpose vehicles (SPVs) or restricted accounts, to protect the lender’s position and improve recovery prospects.