Provided by Kapstream

For a time, the benefits from allocations to fixed income were vastly reduced as interest rates were lowered to stimulate our way out of the pandemic. Investors, in their chase for yield, reallocated into higher yielding and more volatile sectors within the asset class, either going down the credit spectrum, capital structure or giving up liquidity to seek a positive yield. For a while, TINA (‘There Is No Alternative’, to equities, or riskier debt categories) dominated. Share indices generally doubled on the back of the resulting demand, with the S&P500 rising from an index level of below 2200 in March 2020 to above 4800 at the start of 2022. To be fair the rise in equities was partly justified as earnings boomed in line with the speed of the economic recovery, but the price-earnings multiple surging to multi-decade highs above 30 shows that this was not just about the fundamentals.

Times are now changing. The surge in inflation that came out of the pandemic, reflecting both supply side issues and the stimulus it prompted, has seen interest rates rise. The surge in prices and resulting monetary policy response from central banks has damaged economic growth, negatively impacting earnings and equity prices. Price-earnings multiplies have retreated from around 30 to below 20. At the same time, the rise in interest rates has seen fixed income become more attractive in a relative sense. Step aside TINA. CINDY (‘Credit Is Now Delivering Yield’) has returned!

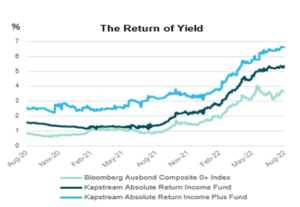

To give an idea of just how far fixed income has come, it may be useful to look at where yields are now relative to mid-2020 when the majority of rate cuts had been implemented. In the US, interest rates on broad fixed income benchmarks (e.g. US Corporate Aggregate) have now seen yields rise from around 2% to be above 5%. Australian equivalents (e.g. Bloomberg Ausbond Composite 0+ index) have seen yields rise from <1% in 2020 to be closer to 4% currently. The Kapstream Absolute Return Income Fund has shown a larger increase in yield than both these benchmarks, rising from around 1% in mid-2021 to reach close to 5½% today.

Source: Bloomberg, Kapstream

This increase in yields provides a number of benefits to fixed income investors:

- They provide investors with the greater potential for a larger amount of income going forward, capably re-fulfilling the ‘income’ requirement of client portfolios;

- A higher yield provides a much higher buffer against adverse market movements in avoiding negative absolute returns;

- Official interest rate increases and higher yields mean that fixed income has more ‘room’ to act as a diversifier in recessions and falling equity environments, re-fulfilling the defensive hedge benefits of holding fixed income in investor

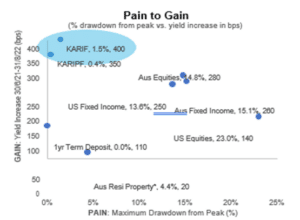

These benefits have come at a cost though, as absolute returns for more conventionally managed fixed income exposures turned negative when the yield was increasing off its historically low base. When picking the appropriate fixed income investment it’s worth examining the extent of these costs relative to the benefits. One eminently rational way of considering the risk/reward relationship of the options available following such periods of challenge is to plot the ‘pain’ (the drawdown from peak) suffered through a period of decline against the forward looking ‘gain’ (the increase in yield) that the category or asset exhibits. In other words, what is the cost to investors of securing the opportunity of a richer forward looking return from that category or asset. The chart below plots a sample of mainstream asset classes against defensive absolute return fixed income, using Kapstream funds as a proxy.

Source: Kapstream, Bloomberg, Corelogic, SQM research, RBA, *drawdown excludes cost & rentals

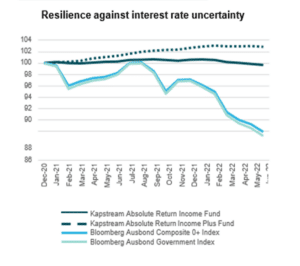

On this measure, you want to be in the top left quadrant, where our strategies are clear standouts; low pain (just a 1.5% decline in value in the case of our flagship Kapstream Absolute Return Income Fund/‘KARIF’, and only a 0.4% drawdown on our Kapstream Absolute Return Income Plus Fund/‘KARIPF’), with relatively high forward gain; yield-to-maturity improvement of 400bps and 350bps respectively. Thus the ‘pain to gain’ ratio is stronger than with any other observable category. True, equities do offer stronger potential for capital gain in addition to their income yield, but being ‘early’ holds risk of further value detraction if volatility persists and further equity market corrections occur. The following chart highlights the active avoidance of drawdown through the challenging environment of recent times for both Kapstream funds.

Source: Kapstream, Bloomberg as at June 2022. Fund returns are gross of fees and should not be relied upon as an indicator of future performance.

We conclude that the higher yield environment has seen the era of TINA replaced with the benefits and attraction of CINDY, making certain (but not all) fixed income products far more attractive in a relative and absolute sense than they have been in the recent past. Periods like what we have been through highlight the importance of strategies that actively managed the downside while still capturing upside potential on a balanced basis. Defensive, low duration absolute return-oriented fixed income solutions such as the Kapstream Absolute Return Income Fund and Kapstream Absolute Return Income Plus Fund deserve consideration, helping to deliver the benefits of the higher yield environment with far less downside risk than many popular asset classes in the current environment of continued uncertainty around interest rates.

This material has been prepared by Kapstream Capital Pty Limited (ABN 19 122 076 117 AFSL 308870) (Kapstream), the investment manager of the Kapstream Absolute Return Income Fund & Kapstream Absolute Return Income Plus Fund (‘Funds’). Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante) is a member of the Challenger Limited group of companies (Challenger Group) and is the responsible entity of the Funds. Other than information which is identified as sourced from Fidante in relation to the Funds, Fidante is not responsible for the information in this material, including any statements of opinion. It is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial adviser, whether the information is suitable to your circumstances. The Funds Target Market Determination and Product Disclosure Statements (PDS) available at www.fidante.com should be considered before making a decision about whether to buy or hold units in the Funds. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Past performance is not a reliable indicator of future performance. Any projections are based on assumptions which we believe are reasonable but are subject to change and should not be relied upon. Kapstream and Fidante have entered into arrangements in connection with the distribution and administration of financial products to which this material relates. In connection with those arrangements, Kapstream and Fidante may receive remuneration or other benefits in respect of financial services provided by the parties. Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.